Are you paying too much for your home loan? Big changes are hitting the Singapore mortgage market this week. Local banks are making moves that could impact your wallet. Do not let your monthly installments surprise you! Read on to stay ahead of the game.

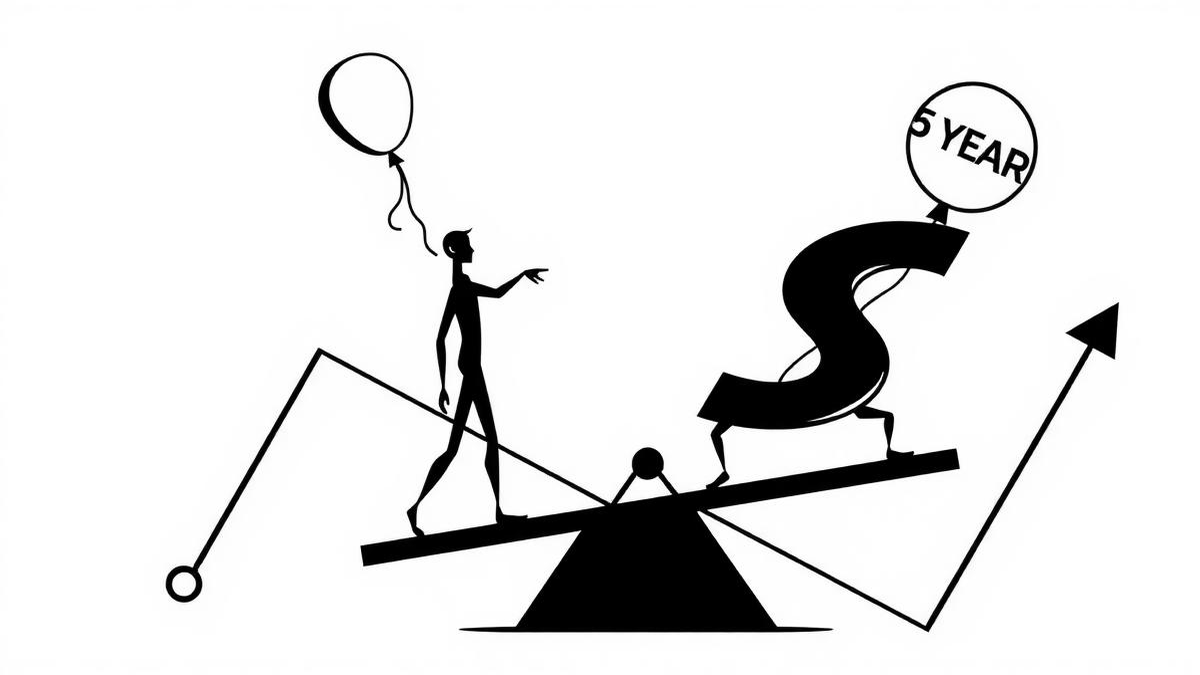

The Rising Trend

- Local banks are removing long-term fixed rate packages.

“DBS has removed their 5 years fixed rate (HDB case). UOB updated that they will remove their 5 years fixed rate soon.”

- Three-year fixed rates are trending upwards this month.

“Local banks has increased their 3 years fixed rate slightly.”

- New District 15 launches are reaching completion.

One popular insight from a forum member noted projects like Liv MB are finishing soon. The community is watching these completions closely. District 15 remains a hot topic for buyers. Many are looking at Tembusu Grand and Grand Dunman. These developments change the local landscape.

Interest rates remain a primary concern for homeowners. The current US interest rate is around 3.5%. This affects how our local banks price their loans. Some banks are adjusting their strategies right now. They are focusing on shorter-term fixed rates instead. This creates a shift in the market pulse.

The Real Struggles

- Homeowners face a loss of long-term peace of mind.

“It is a question if you want flexibility or peace of mind.”

- Rising interest rates make monthly repayments more expensive.

“The current US interest rate is around 3.5%.”

- High insurance premiums are linked to inflated building valuations.

One forum member shared a struggle with expensive fire insurance. Their bank valuer set the building replacement value at 2.5 million dollars. This high valuation leads to very expensive premiums. Many owners feel stuck with bank-mandated insurance providers.

Refinancing also brings new challenges for landed property owners. New valuations must be done during every refinancing cycle. These valuations directly affect your insurance costs for years. One user noted their replacement cost was only 1 million dollars. The discrepancy between different valuers can be huge. This adds stress to the financial planning process.

Smart Action Steps

- Secure a three-year fixed rate for immediate stability.

“Locking in 1.50% for a full 3 years is quite attractive today.”

- Shop around for your own fire insurance policy.

“Since your bank allows you to take up a policy from any insurance company, you can just write in to those major insurance companies to request for a quote.”

- Choose shorter lock-in periods if you expect rates to fall.

Flexibility is key in a changing market. A shorter lock-in allows you to secure lower rates later. One popular insight suggested that a 0.05% difference is not always impactful. Focus on the overall strategy instead of tiny numbers.

Always ask your valuers how they derive their numbers. This is especially true for landed property owners. Understanding the building replacement value can save you hundreds. Check if your bank allows outside insurance providers. Many major insurance companies offer much cheaper rates. These small steps lead to big savings over time.

Stay informed about the latest bank movements. The property market in Singapore moves very fast. Community consensus shows that being proactive pays off. Don’t wait for your bank to call you. Take charge of your home loan and insurance today. Your future self will thank you for the savings!

Read the original discussions on HardwareZone: