See the latest condo prices and feel your heart drop? You are not alone. Every coffee shop chat seems to end with one big question. Can we still afford a home in Singapore? The market feels hotter than a hawker centre kitchen. But don’t panic. Before you jump in, let’s look at what’s really happening. Understanding the market is your first step to making a smart choice. Let’s break it down, HardwareZone style.

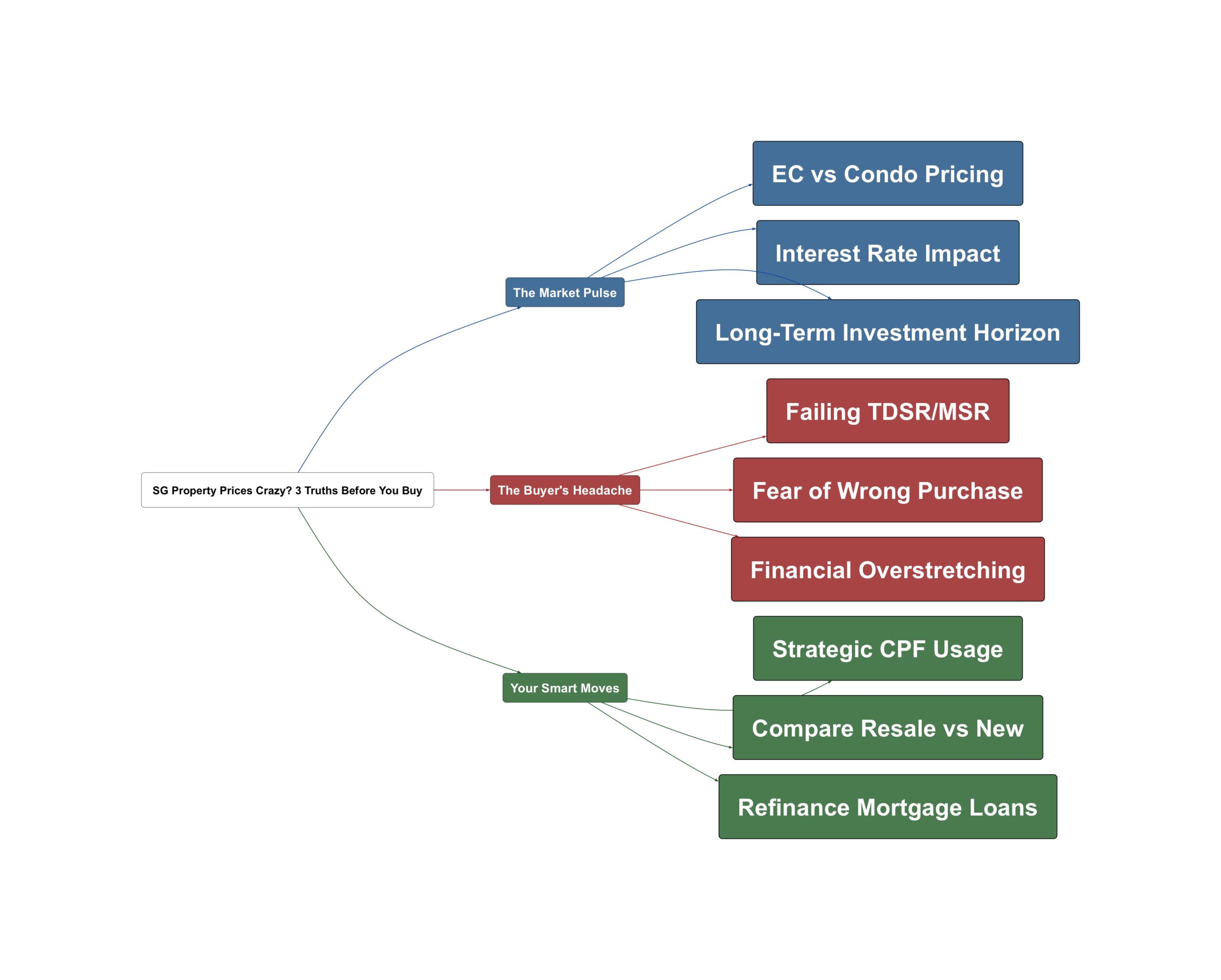

The Market Pulse

The Singapore property market is moving fast. Prices for both new and resale homes are climbing. Forum discussions show a mix of excitement and anxiety. Here are the key trends Singaporeans are talking about right now.

- The line between ECs and Condos is blurring.

These days of $17xx psf EC are supernormal liao. With that price can str8 buy resale in the same vicinity which you can at least walk in viewing to touch touch.

- Interest rates are driving major decisions.

Low interest rates meaning those buyers bey song getting pennies for their monies park in banks, so take out whack condo lor.

- Smart buyers are playing the long game.

This thread doesn’t make sense when you all keep talking about 2-3 years time People hold property is for long term. 10 years.

The Buyer’s Headache

Buying property in Singapore is not easy. Beyond the high prices, there are real challenges. These are the major roadblocks and worries shared by many aspiring homeowners. They can cause a lot of stress and confusion.

- The fear of making a massive mistake is real.

Actually,I more worry first time buy pte property buy bad unit bad project and wrong price.

- Navigating loan rules like TDSR is a huge hurdle.

rejected due to failed tdsr. I tried with existing bank -3% DRP, but they said reprice is ok, but pledge will remain. hence, no use too.

- The stress of overstretching finances is a top concern.

Will it be overstretched? Quite stressful right?

Your Smart Moves

Feeling overwhelmed? Don’t be. You can navigate this tough market with the right strategy. The community has shared practical tips that can help you. Here are three actionable steps you can take to secure your home without losing your mind.

- Master your finances and use your CPF wisely.

I always empty CPF for downpayment and keep as much cash on hand……how come so funny never touch CPF at all for both properties.

- Compare all your options, especially resale properties.

Nowadays both EC and condo resale prices not much difference if everything else sama sama.

- Plan your payments for the long term.

I got now till 2028 to raised about 1million. … now just work hard for the $$$ then come 2028 I see the situation then

Buying a home in Singapore feels like a huge challenge. The prices seem to only go up. But it is not an impossible dream. Do your homework. Understand your finances completely. Compare every option available to you. With careful planning, you can make a choice that is right for you and your family. Your property journey starts with smart decisions, not rushed ones.

Read the original discussions on HardwareZone: