Just weeks after reports of multi-million dollar contracts and a frantic talent war, Meta has slammed the brakes on AI hiring. This sudden reversal has sent shockwaves through the tech industry, sparking a fierce debate on Hacker News: is this a strategic pause or the first sign that the AI hype bubble is about to burst?

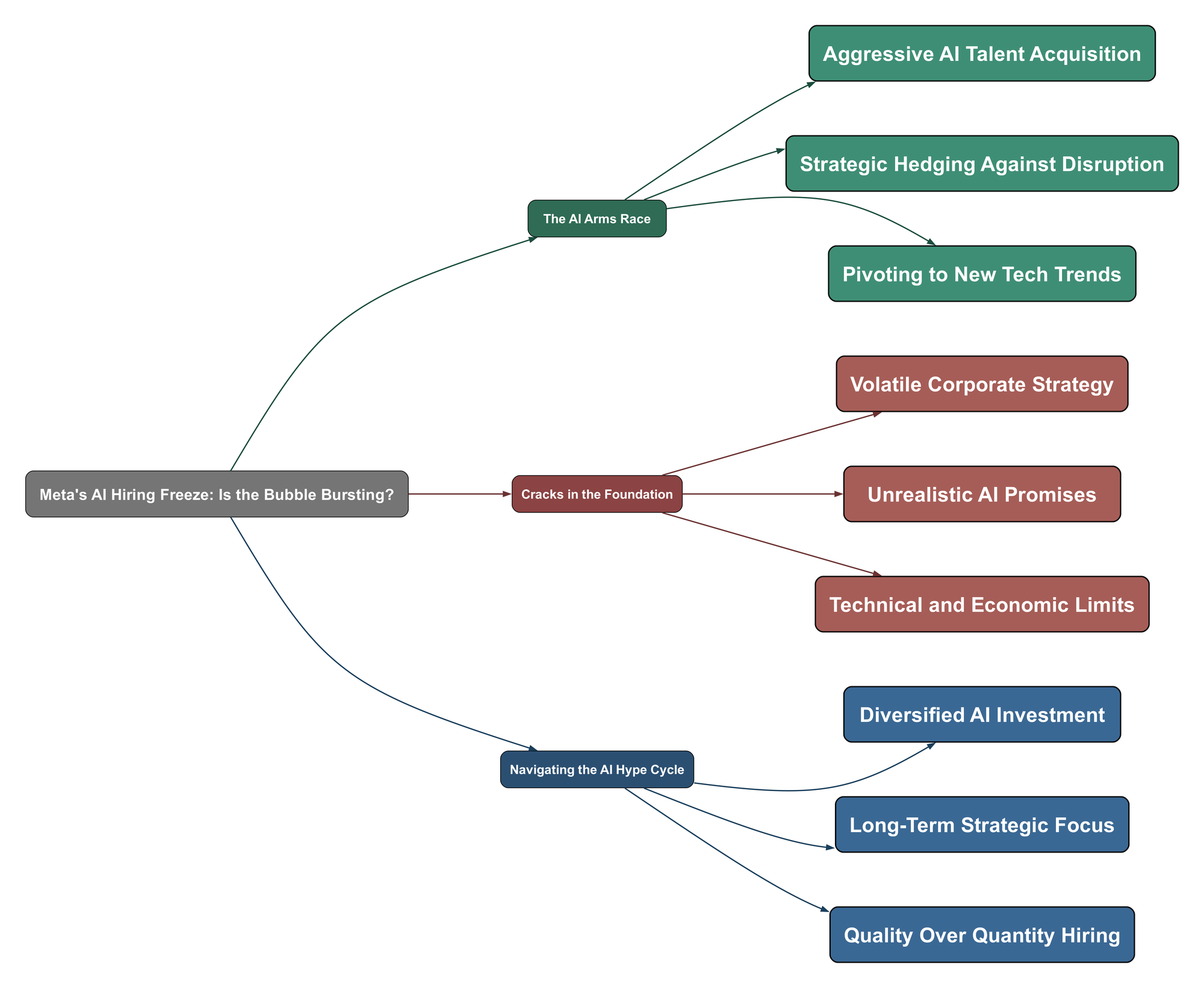

The AI Arms Race

The tech landscape has been dominated by an aggressive push into artificial intelligence, driven by a few key factors:

- Massive Talent Investments: Companies like Meta were engaged in a fierce bidding war, offering what one user called “record-setting bonuses” and “generational wealth” to secure top AI researchers and engineers.

- Strategic Survival: For incumbents, AI investment is seen as a crucial defensive move. The fear is falling behind and becoming the next BlackBerry, a cautionary tale for tech giants. As one commenter noted, it’s a bet where if you don’t participate, you’re “likely to completely die out from a generational shift.”

- Chasing the Next Big Thing: Meta, in particular, has a history of making huge, rapid pivots into emerging technologies—from mobile to the Metaverse, and now to AI. This latest frenzy is part of a pattern of spending billions to capture the future, even if past efforts have fizzled out.

- Deep Pockets Fueling the Fire: With an operating income of $78.7 billion in the last year, companies like Meta have the capital to make these colossal bets, further inflating the market for AI talent and resources.

I look at some of the… generated terrain/interaction and can’t help but think that’s a natural coupling to FB/Meta’s investments in their VR headsets. They could potentially completely lose on a platform they largely pioneered.

Cracks in the Foundation

Despite the massive spending, the sudden hiring freeze reveals deep-seated problems and growing skepticism about the current AI trajectory:

- Volatile and Erratic Strategy: The whiplash from massive spending to a hiring freeze in a matter of months suggests a lack of a coherent long-term plan. This volatility has led many to question the leadership’s competence.

- Unrealistic Promises and Hype: There’s a growing sentiment that the promises of AGI and revolutionary change are overblown. Many believe a market correction is imminent, where a lot of investment money is going to “evaporate before the market resets.”

- Technical and Economic Ceilings: The physical and financial limitations of scaling AI are becoming apparent. Moore’s Law is effectively over, and the computational power required for next-generation models is becoming prohibitively expensive, with many current models already running at a loss.

These changes in direction (spending billions, freezing hiring) over just a few months show that these people are as clueless as to what’s going to happen with AI, as everyone else.

Navigating the AI Hype Cycle

The discussion points toward a more sustainable and strategic path forward, moving beyond the current boom-and-bust cycle:

- Invest in Application, Not Just Hype: A wiser strategy is to invest in established companies with profitable core businesses that are effectively integrating AI, rather than betting on pure-play AI moonshots. As one user’s financial advisor wisely suggested, it’s better to back “companies that invest in AI (like MS) but who had other profitable businesses (like Azure).”

- Commit to a Long-Term Vision: Instead of constantly chasing the next trend, leaders need to show more resolve. The advice is to either “invest far less” in exploratory bets or “stick with them long enough to work out all the issues and build the growth over the long term.”

- Prioritize Quality Over Quantity: The frantic rush to hire thousands of engineers may be less effective than a focused approach. The consensus is shifting towards a more deliberate strategy of acquiring top-tier talent that can deliver tangible results, embodying the principle of “Quality over quantity.”