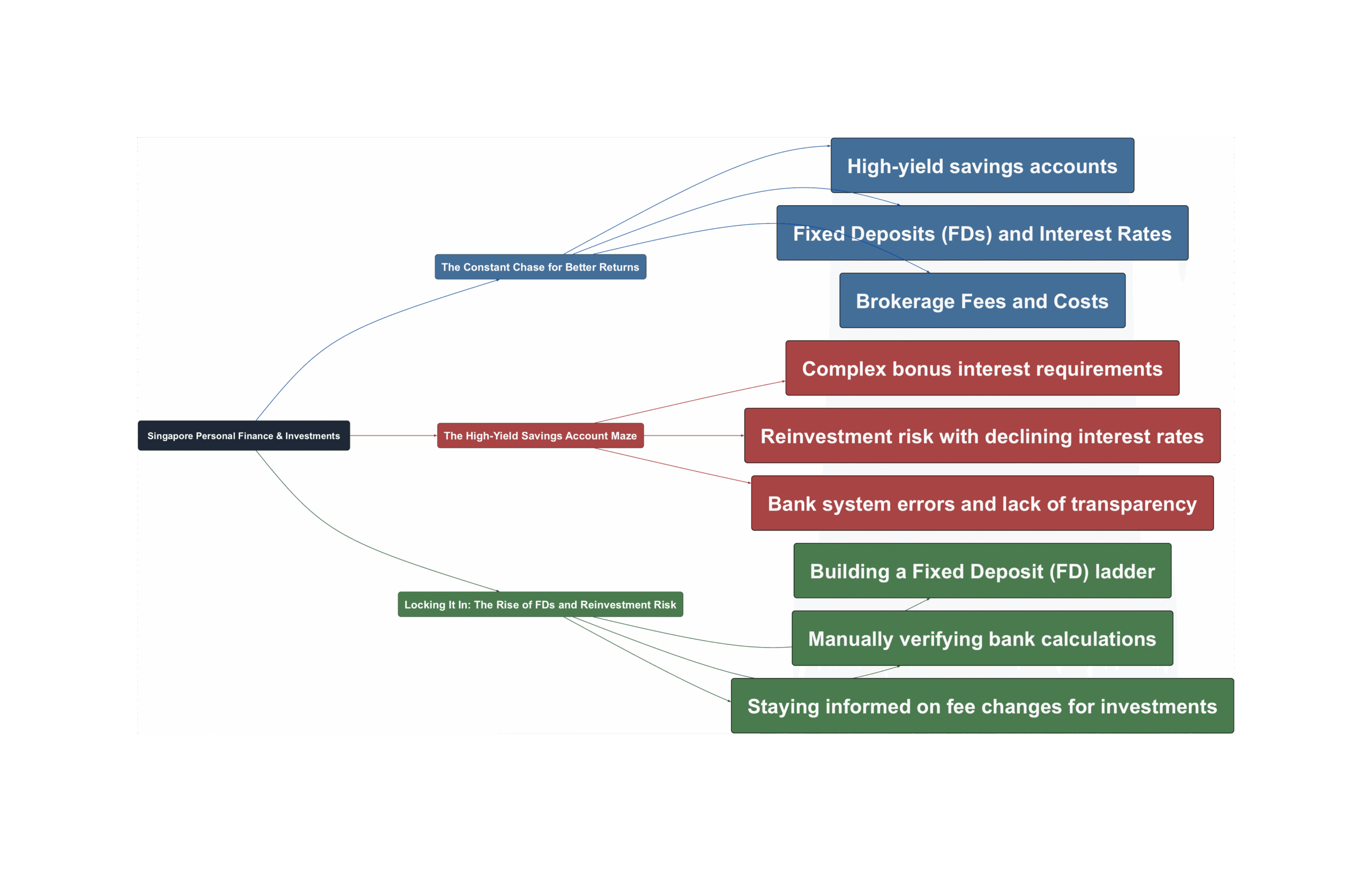

The Constant Chase for Better Returns

In Singapore’s competitive financial landscape, the quest for higher returns is a national pastime. From high-yield savings accounts to fixed deposits and low-cost investing, Singaporeans are constantly strategizing. But as recent discussions show, navigating this world requires vigilance, savvy, and a bit of frustration management.

The High-Yield Savings Account Maze

Accounts like the OCBC 360 and DBS Multiplier promise attractive bonus interest, but they come with a complex web of rules. A major hurdle for many is the salary credit requirement.

“Most HR payroll system can only allow input of 1 bank account,” one forum user explains, highlighting a common frustration. While employees want to split their salary to satisfy multiple banks’ criteria, company payroll systems, even sophisticated ones like SAP, often lack this flexibility. This turns a simple goal—earning more interest—into a logistical headache.

Furthermore, these accounts are not static. Banks can and do change the rules. Even worse, their systems can make mistakes. Users on one forum noted that a DBS Multiplier interest notification was calculated incorrectly. “Scary such a simple mistake could be made for a bank when calculating interest,” a user remarked. The key takeaway? Always double-check your statements.

Locking It In: The Rise of FDs and Reinvestment Risk

With interest rates facing potential declines, many are turning to Fixed Deposits (FDs) to lock in current high rates. As one contributor wisely noted, “more people understand what reinvestment risk means now.” Locking in a 3% rate for three years seems much smarter when prevailing rates are expected to fall.

However, FDs have their own challenges. Long tenures can be daunting, and you often need a significant sum to see a meaningful return. To combat this, savvy savers employ strategies like an FD ladder, where multiple FDs with staggered maturity dates provide a steady stream of cash flow while keeping funds locked in at favorable rates.

Good News for Investors: A Look at Brokerage Fees

It’s not all hurdles and headaches. For those investing in US markets, there’s been a positive development. As of May 2025, fees for selling US stocks and ETFs have been reduced. Notably, the SEC Transaction Fee has been effectively waived (dropped from $0.0000278 * Value to $0.00 * Value), and FINRA Audit Trail Fees have also been lowered. This is a welcome change that reduces the cost of trading for retail investors using brokers like Interactive Brokers (IBKR).

Your Financial Playbook

So, how do you win the Singapore money game? The consensus from the community is clear:

- Be Vigilant: Manually check your bank statements and interest calculations. Don’t blindly trust app notifications.

- Understand the Rules: Read the T&Cs for high-yield accounts. Know exactly what you need to do to earn that bonus interest.

- Think Long-Term: Consider using FDs or building an FD ladder to protect yourself from falling interest rates and reinvestment risk.

- Stay Informed: Keep up with changes in both banking products and investment-related fees. Small changes can make a big difference to your bottom line.

Read the original discussions on HardwareZone: