Checked your bank account lately? That tiny interest payment can feel like a slap. It’s not just you. Savings account rates in Singapore are falling fast. Your hard-earned money is earning less and less. Are you leaving cash on the table every month? It’s time to stop the leak. Let’s look at what’s happening and how you can fight back. Don’t let your savings sleep.

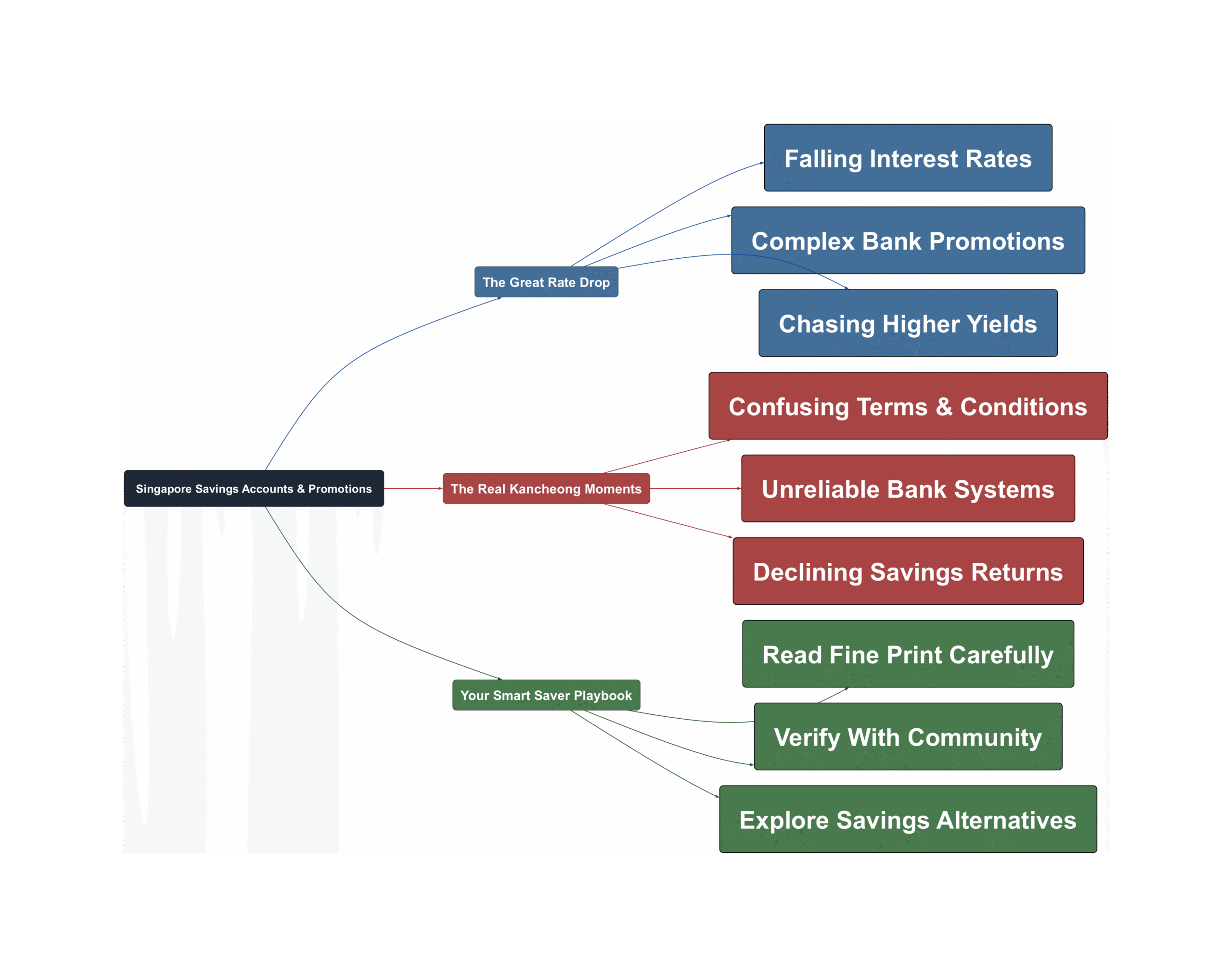

The Great Rate Drop

The golden era of high-yield savings seems to be over. Banks across Singapore are quietly slashing their interest rates. This trend affects almost every popular savings account. What was once a simple way to grow your cash now requires more strategy.

- Major banks are cutting rates significantly

Banks are reducing interest across the board. For example, BOC Smartsaver’s effective interest rate (EIR) was halved. It dropped from a decent 2.62% to about 1.32%. CIMB FastSaver followed suit. Its EIR for S$75,000 will fall from 1.99% to 1.72%. Even fixed deposit rates are facing pressure.

“2.6% is really considered good for now. Everywhere dropping interest.”

- Savers are constantly moving their funds

To cope, savvy Singaporeans are playing a game of musical chairs with their money. They hunt for the best promotional rates. Once a bonus interest period ends, they move their cash. This has become a common monthly routine for many.

“Bonus is in. Time to move money out.”

- The definition of a ‘good’ rate has changed

Not long ago, earning over 3% was the goal. Now, forum users agree that anything above 2.5% is a great deal. This shift shows how much the market has changed. Savers must adjust their expectations and strategies accordingly.

The Real Kancheong Moments

Chasing the best rates comes with its own set of headaches. It’s not as simple as just moving your money. Many savers face confusing rules and frustrating system errors. These challenges can make you feel like you’re fighting a losing battle.

- Bank promotions have confusing mechanics

The terms and conditions are often incredibly complex. For some promos, depositing funds just one day too early can disqualify you. Users spend hours doing “napkin math” to understand the tiered interest structures. It’s easy to make a mistake and lose out on months of bonus interest.

“Their interests got the MOST COMPLICATED tiering which doesn’t allow easy calculation for customers”

- Bank systems and notifications are unreliable

Many have experienced banks sending SMS notifications with incorrect interest calculations. This causes unnecessary panic and confusion. It also means you cannot fully trust the information sent to you. You must verify the numbers in your account yourself.

“scary such a simple mistake could be made for a bank when calculating interest”

- Customer service can be a frustrating experience

When issues arise, getting clear answers is tough. Relationship Managers may push other products like structured deposits or investments. Getting a straight answer about a simple savings promo can feel impossible. This leaves customers feeling unheard and frustrated.

Your Smart Saver Playbook

Despite the falling rates and confusing rules, you can still win. It just requires a more proactive approach. You need a clear plan to protect and grow your savings. Here are some actionable steps you can take today.

- Read the T&Cs like a hawk

Never assume you know how a promotion works. Read the terms and conditions carefully. Pay close attention to eligibility dates and qualifying criteria. One user noted how a transaction on December 31st versus January 1st completely changed the promo they qualified for. The details matter.

“All i can say is to read through the TnC Point 10 – Illustration. The crucial point is that CIMB looks at end of day balance.”

- Use the community for verification

You are not alone in this. Forums like HardwareZone are powerful tools. Users share when bonuses are credited and compare calculations. If a bank’s notification seems wrong, check with others. This collective knowledge helps everyone stay on track.

“every month better double check, and check with other bros here.”

- Explore alternatives beyond savings accounts

If savings rates are too low, look at other options. Some users are considering Singapore Savings Bonds (SSBs) for stable returns. Others are using cash to pay down their housing loan instead of their CPF OA. This reduces interest payments, which is another form of saving.

“Time to service housing loan using cash rather than CPF.”

The era of easy high interest might be over. But that doesn’t mean your savings can’t grow. It just means you need to be smarter and more diligent. Stay informed, read the fine print, and don’t be afraid to move your money. It’s your hard-earned cash, after all. Make it work for you.

Read the original discussions on HardwareZone: