Are you feeling the heat in Singapore’s property market? From HDB flats to private condos, prices seem to be on a rollercoaster. Many Singaporeans are asking: Is a property bubble about to burst? Or will prices keep climbing? Let’s dive into what HardwareZone forumers are discussing. Their insights offer a glimpse into current market sentiments.

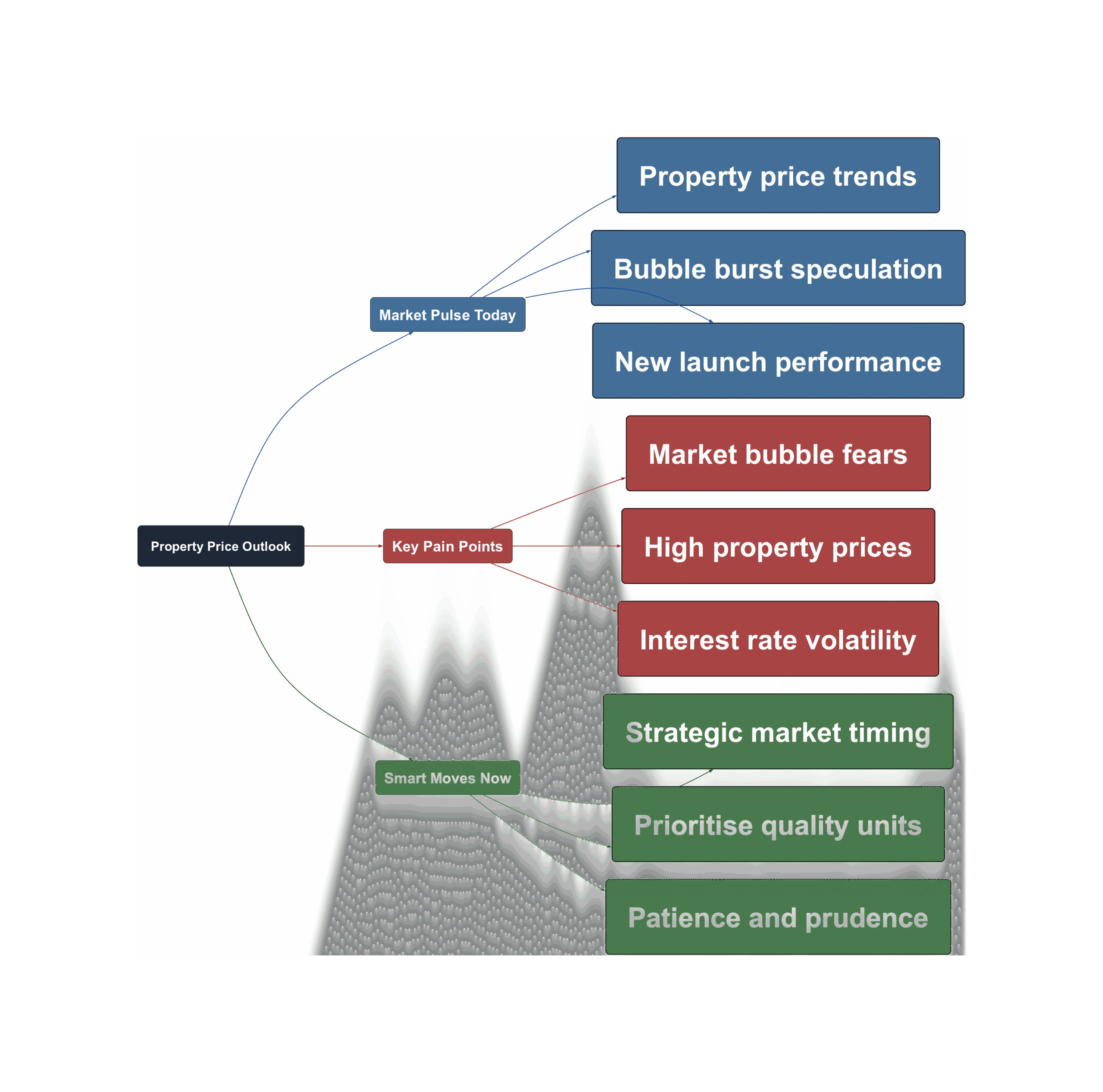

Market Pulse Today

- Some properties see no price increase

Certain new launches are struggling to appreciate. For example, some forumers noted specific projects like ‘TG’. Their prices have remained stagnant since launch. This suggests a varied market performance.

“TG’s price didn’t go up at all. Sad case.”

- Others show active transactions

In contrast, other projects like ‘Sora’ are seeing healthy transactions. This indicates demand exists for specific developments. Buyers are still active in the market. Location and project quality play a big part.

“U go check Sora transactions and will be”

- GLS bidding remains competitive

Government Land Sales (GLS) bids are still strong. Developers continue to bid aggressively for land. This shows confidence in future market demand. It also signals potential for new launch prices to stay firm.

“GLS bidding still hot.”

- Good units find takers even in slowdowns

The market might slow down. However, quality units still attract buyers. This highlights the importance of property fundamentals. Location, layout, and amenities matter greatly. Smart buyers look for value.

“That’s why it’s impt to buy good units, not just any unit. During slow down if you are holding onto a good product, there will still be takers.”

Key Pain Points

- Fear of a massive property bubble

Many Singaporeans believe the market is overheated. They worry about an impending bubble burst. This concern has been present for a while. Predicting the timing remains difficult. But the sentiment is strong.

“Wait for the bubble to burst like some bros said. The bubble sibei big already mah. So maybe tomorrow burst? If not next year? Or 5 years later? Or next life also possible la. Definitely will come”

- High property prices are a concern

Current price points are seen as unsustainable by some. ECs at $1.65k-$1.7k psf are mentioned. Condo prices range from $800-$1700 psf. These figures spark affordability worries. Many feel prices are simply too high now.

“$1.65k psf for EC? I think more like $1.7k psf”

“Anything more is too expensive and huge bubble.”

- Interest rate volatility creates uncertainty

Past fears about rising interest rates linger. High rates impact mortgage payments significantly. This adds another layer of risk for homeowners. The future of interest rates is always a concern. It affects buying power.

“1 year ago, someone said interest rates will so high until Bedok reservoir will be filled with bodies.”

Smart Moves Now

- Consider strategic market timing

Some owners are choosing to cut their losses. They free up capital for other opportunities. This suggests a proactive approach to market cycles. It’s about ‘long pain short pain’. Time is money in property. This move is about moving on.

“Owner 长痛不如短痛, time is money, cut loss, free up the name and move onto others is my guess.”

- Prioritise quality and location

Buying good units is crucial. These properties tend to hold value better. They also attract buyers even in slower markets. Focus on strong fundamentals. This strategy offers more resilience.

“That’s why it’s impt to buy good units, not just any unit.”

- Practice patience and prudence

Avoid rushing into big decisions. Some advise waiting for keys to be ready. Others suggest waiting for more market information. This ‘last mover advantage’ can be beneficial. Do your homework thoroughly.

“wah this one buyer tan tio. basically buying into 2 years ago’s pricing and wait another 1 year +/- can take keys alr.”

“Ok we wait for final plot. Last mover advantage”

The Singapore property market remains dynamic. While some fear a bubble, others see opportunities. It’s crucial to stay informed and make wise choices. Do your homework before making big property moves. What’s your take on the market? Share your thoughts!

Read the original discussions on HardwareZone: