Are you feeling the pinch? That nagging worry about Singapore’s future, especially with rising costs and global shifts, isn’t just in your head. Many Singaporeans are openly discussing their concerns on platforms like Reddit, wondering if our little red dot is losing its competitive edge. From soaring HDB prices to multinational corporations (MNCs) rethinking their presence, the conversations are getting real. Let’s dive into what’s happening, why it’s a challenge, and what we can do about it.

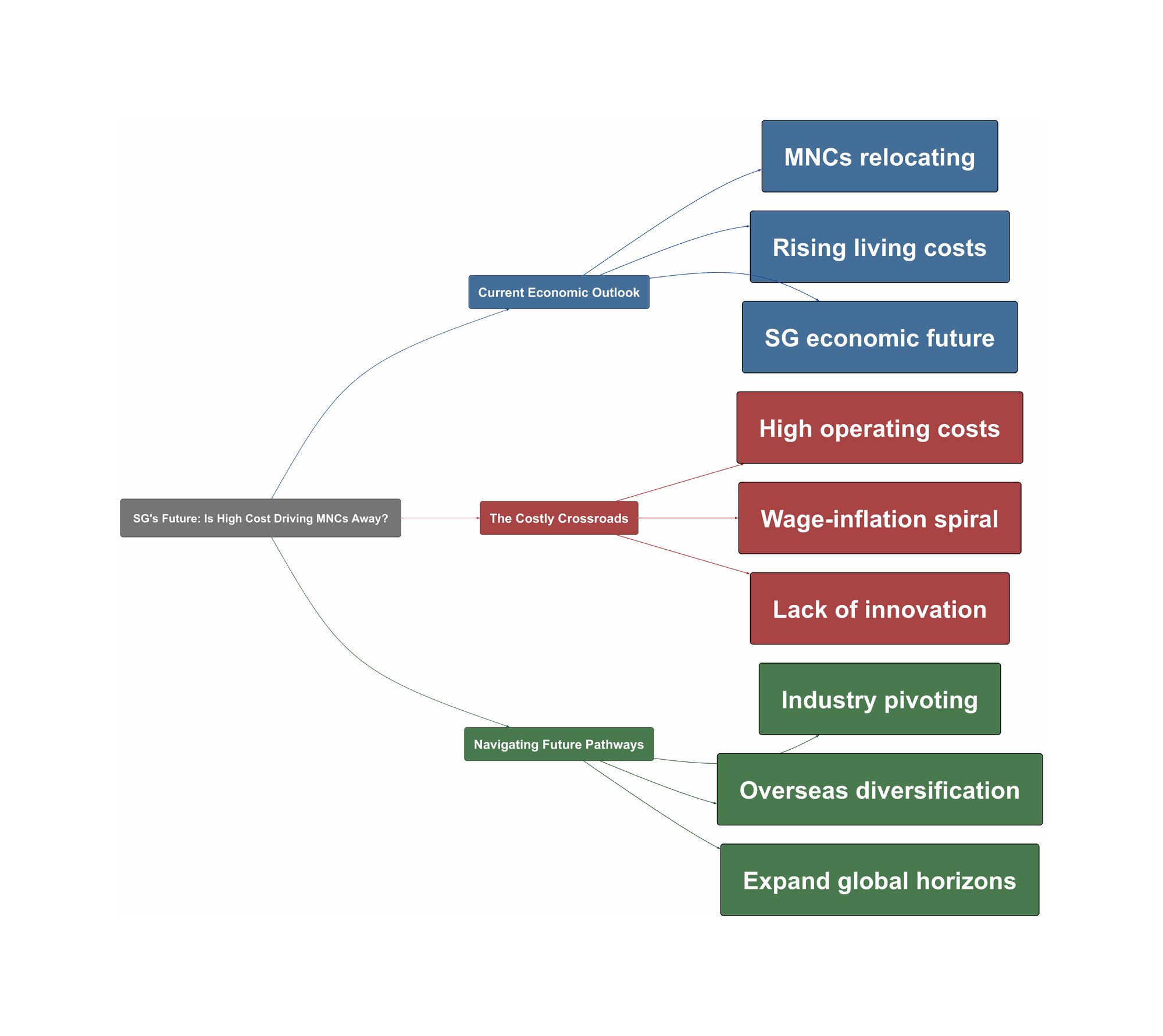

Current Economic Outlook

Singapore has long been a global economic powerhouse, attracting major foreign investments and establishing itself as a hub for various industries. However, recent trends suggest a shift. Some Redditors observe MNCs, even those outside ‘sunset industries’ like oil and gas, scaling back or relocating departments to neighbouring countries. While official statistics like the SingStat report show a rise in median household income to S$10,869 in 2023, the sentiment on the ground reflects a different story for some.

“Lately a bit worried about where Singapore is heading in the next 5 to 10 years. Last time I worked in oil and gas — saw some of the big players pack up and leave.”

This isn’t just anecdotal; companies in sectors like EdTech are also feeling the squeeze, losing their market lead to regional neighbours with larger populations and lower operating costs. Singapore’s economy is increasingly tertiary, focusing on services, which means growth is often less visible than the rapid industrialisation seen in other ASEAN nations.

“Am in EdTech and our market used to be the biggest player in Asia. Now our regional neighbours have overtaken us and my HQ’s headcount here is dwindling.”

The Costly Crossroads

The core of the anxiety often boils down to Singapore’s high cost of living and doing business. The strong SGD makes us expensive compared to our peers, and local inflation, particularly in housing, creates a challenging feedback loop. When HDB flats hit S$900,000 or coffeeshops sell for S$40 million, it pushes up the overall price ceiling, making everything else more expensive. The proposed solution of endless wage growth to combat inflation is seen by many as unsustainable, as businesses will simply move to cheaper locales.

“If that’s the only solution we have we are screwed. Due to the very strong SGD, we are already very expensive relative to our peers.”

Many white-collar jobs based in Singapore, particularly those within MNCs, are often ‘cost centres’ that don’t require top-tier talent, making them prime candidates for relocation when costs escalate. This leaves Singapore vulnerable, as our value proposition diminishes. There’s also a concern that Singapore has become too comfortable as a ‘middleman’ and hasn’t innovated enough, potentially missing the boat on new industries like AI, and instead focusing on attracting rich individuals rather than fostering broad-based growth.

“With the increasing costs of doing business in SG, and our neighbours having the easier game of playing catch up in terms of education we no longer have that value proposition anymore.”

Navigating Future Pathways

While the challenges are real, the Reddit discussions also offer practical advice for Singaporeans looking to secure their financial and professional future. One key strategy is to diversify your assets globally. Investing in overseas equities can provide a hedge against localised inflation and economic shifts within Singapore, ensuring your wealth isn’t solely tied to the local market. This approach is gaining traction among those who foresee continued cost pressures at home.

“just diversify into overseas assets (equities). That is what I have been doing for the past decade.”

Another crucial piece of advice, especially for younger Singaporeans, is to expand your horizons beyond our shores. This doesn’t necessarily mean migrating, but actively seeking opportunities to work, study, or gain experience abroad. This exposure can broaden your perspective, equip you with diverse skills, and make you more adaptable in a rapidly changing global economy. It’s about being proactive and not waiting for the government to lead all innovation.

“If young, look abroad. Not necessarily to migrate but to expand your horizons rather than think in very Singaporean terms which is quite myopic and conservative.”

Ultimately, Singapore as a nation must continue to pivot industries and embrace change, and individuals must also adapt. By taking control of our personal finances and career paths, we can build resilience against potential economic headwinds and ensure a more secure future.