Ever felt that knot in your stomach when your home loan interest rate climbs? For many Singaporean homeowners, navigating the property market and securing a good mortgage rate feels like a constant battle, especially with fluctuating global interest rates. The good news is, you’re not alone! Discussions on forums like HardwareZone show that many Singaporeans are actively looking for ways to manage their home loans, from understanding different packages to seizing repricing opportunities. Let’s dive into what the community is saying and how you can make smarter moves to save big on your mortgage.

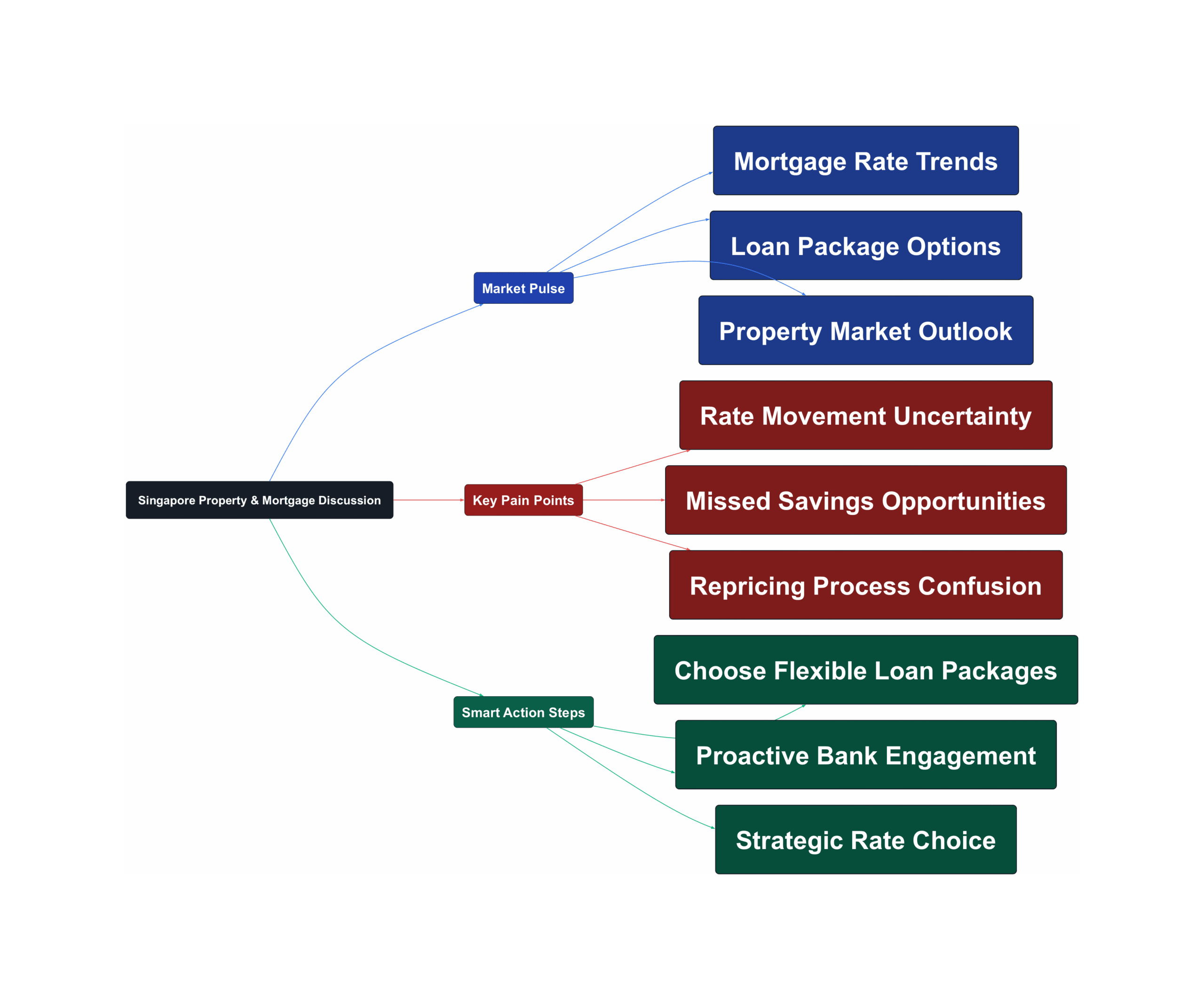

Market Pulse

- Fixed rates have been on a downtrend, making repricing attractive.

“Repriced with ocbc at 2.45% less than 500k loan Previously stuck at 3.75% for 2 years”

- Experts anticipate further rate cuts over the next year.

“Fixed rate has been a downtrend since 2 1/2 years ago. Hence it is not advisable to go with a 3/5 years fixed as it is still expected to go down for the next 1 year at least.”

- Homeowners are actively seeking and securing lower rates, with some getting 2-year fixed rates around 2.4%.

The sentiment from HardwareZone users clearly indicates a shift in the mortgage landscape. Many who were previously stuck on higher rates, some as high as 3.75%, are now successfully repricing their loans to significantly lower figures. This trend is largely driven by the observed downtrend in fixed rates over the past two and a half years, with expectations for this decline to continue for at least another year. This creates a prime window for Singaporean homeowners to review their current loan packages and explore options for savings.

Community members are sharing success stories of obtaining competitive rates, with some reporting 2-year fixed packages at around 2.4%, especially for loan amounts around $1 million, sometimes with specific funding requirements. This proactive approach to repricing is a hot topic, as many realize that waiting passively can lead to missed savings. The discussions highlight a growing awareness among Singaporeans about the importance of staying informed and agile in managing their home loans.

Key Pain Points

- Uncertainty over future interest rate movements.

Homeowners are constantly weighing whether to lock in a fixed rate or opt for a SORA-linked package. The decision is complicated by differing predictions on whether the US Fed will continue aggressive rate cuts or if inflation will cause rates to inch upwards. This creates a dilemma for many trying to predict the best long-term strategy for their finances.

“If you feel that US fed will continues to cut their rates furiously for the next 1-2 years, you can go with SORA package. But try to go with those SORA package that come with 1 years lock in period or free conversion after 1 years as well.”

- Missing out on better rates due to lock-in periods or lack of awareness.

Some users recount instances where they had the option for free conversion but did not utilize it, only to see better rates emerge later. This highlights the frustration of being locked into a less favourable rate or simply not being quick enough to react to market changes. It’s a common fear among homeowners to miss the boat on potential savings.

“for context, i had free conversion after 1 year but I didn’t utilize it because I was quoted 2.68% (back in nov 2024). Not sure what I’ll be quoted this time round but since i will officially be out of lock in, I hope they can provide me with a good rate”

- Confusion regarding repricing terms and conditions.

Many Singaporeans are unclear about the specifics of repricing, such as whether it restarts a new loan term or if they can adjust their loan tenure during the process. The complexity of bank terms and the need to understand new packages can be daunting, leading to hesitation in pursuing repricing opportunities. This uncertainty can prevent homeowners from taking necessary steps to optimize their loans.

Smart Action Steps

- Choose loan packages with flexible conversion options.

When selecting a new loan package, prioritize those that offer “Free conversion after 1 year” or come with a short lock-in period. This flexibility is crucial in Singapore’s dynamic interest rate environment, allowing you to switch to a more favourable rate without penalty if market conditions change.

“But I will recommend that you can go with 2 years fixed that come with ‘Free conversion after 1 years’. So in the event fixed rate drops a lot next year, you still can change the package.”

- Proactively engage your bank for repricing opportunities.

Don’t wait for your bank to contact you. Once you are out of your lock-in period, or even nearing it, reach out to your bank to inquire about repricing options. Banks often have competitive rates for existing customers who are actively seeking to reprice. Be prepared to negotiate and compare offers.

“So far i got 2 client gotten 2.4% fixed for 2 years (But need to fund 30k and lock with them for 6 months). Their loan amount is around 1m”

- Consider a 2-year fixed rate for stability, or SORA if you expect aggressive rate cuts.

If you prefer predictable monthly instalments, a 2-year fixed rate package offers stability, especially if you foresee inflation inching upwards. However, if you’re confident that the US Fed will continue aggressive rate cuts, a SORA package could lead to greater savings. Assess your risk appetite and market outlook before deciding.

Navigating Singapore’s property market and home loan landscape doesn’t have to be a guessing game. By staying informed through community discussions and acting strategically, you can gain better control over your mortgage payments. Whether it’s repricing your loan or choosing a flexible package, every smart move contributes to significant savings. Keep an eye on market trends and don’t hesitate to consult with financial advisors to ensure your home loan strategy is always working for you. Your wallet will thank you!

Read the original discussions on HardwareZone: