Eh, finding where to park your hard-earned money in Singapore can feel like navigating the MRT during peak hour, right? Bank interest rates often feel lower than your phone battery after a day out. You work hard, pay your CPF, maybe save for that HDB downpayment or retirement, but how to make your savings actually grow? You hear people talking about Singapore Savings Bonds (SSBs) and Treasury Bills (T-bills), but which one is the right choice? Don’t worry, we break it down for you, HardwareZone style.

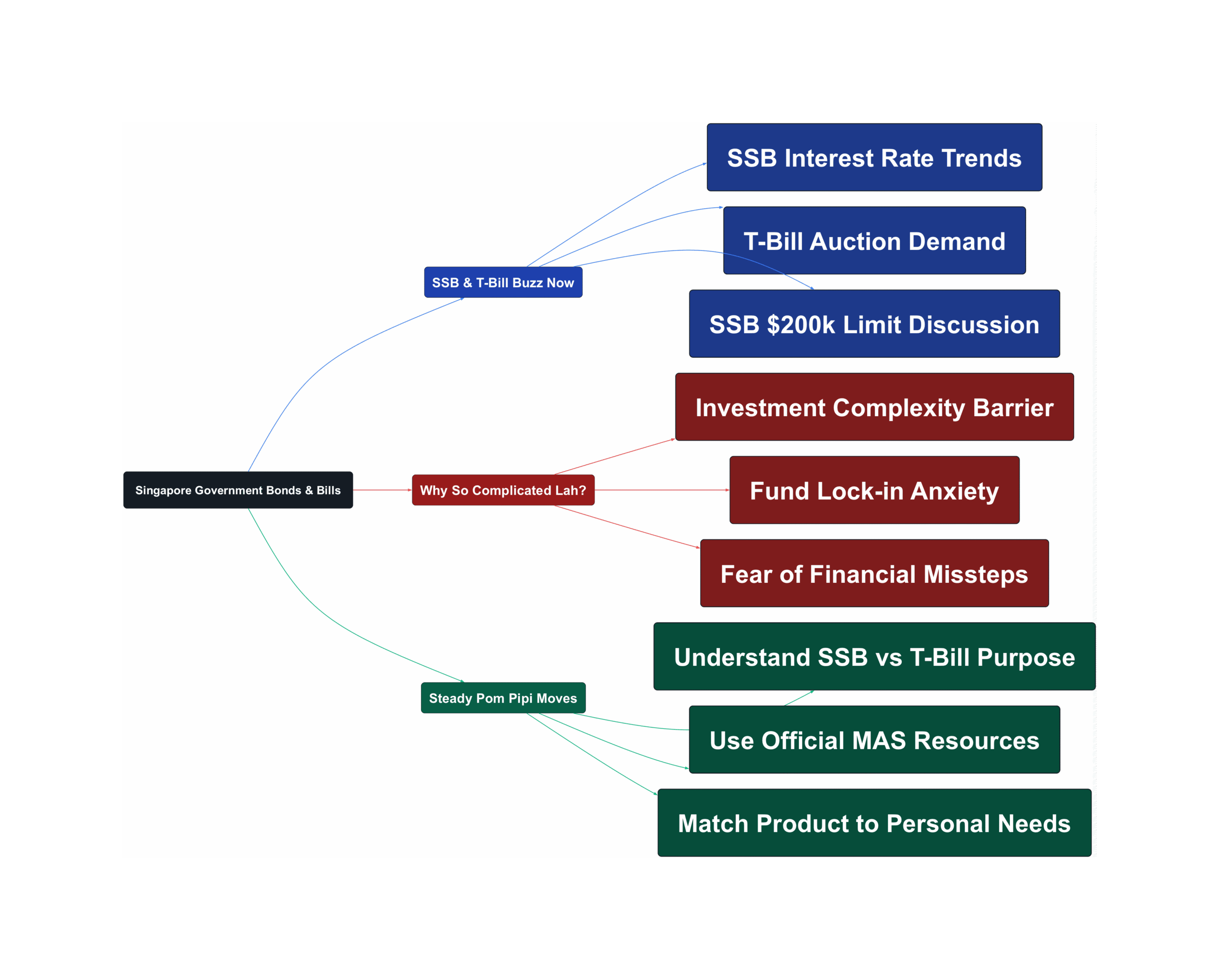

SSB & T-Bill Buzz Now

So, what’s the latestlobang with SSBs and T-bills? These government-backed options are popular for a reason – they are considered very safe. But the details change often, so let’s see what fellow Singaporeans on the forums are discussing.

- SSB Interest Rates Holding Steady

The interest rates for SSBs step up over time. For example, the June 2025 SSB (SBJUN25) starts at 2.20% for the first few years and goes up to 3.12% in the 10th year, giving an average return of 2.56% if you hold it for the full 10 years. This step-up feature is designed to reward long-term savers.

“Final projection byhttps://www.ilovessb.com/projection/SBJUN25, as of 30/4/2025: SBJUN25 … Average return per year % … 2.56”

- T-Bill Demand Remains High

T-bills are shorter-term (6 months or 1 year) and work via auction. Demand can be intense! In a recent auction (April 2025), a massive S$16.6 billion was applied for, but only S$7.4 billion was allocated. The cut-off yield was 2.38%, meaning many people were willing to accept that rate or lower.

“Total amount applied in 23 apr auction was $16.6B vs $7.4B allocated. And the numbers: The yield was 2.38%”

- The $200k SSB Limit Reality

MAS set an individual limit of $200,000 for SSBs to ensure more people can access them. While some forum users discuss hitting this limit, official figures show it’s not that common. As of May 2023, only 4.2% of SSB investors held more than $180,000.

“As at 2 May 2023, just 4.2% of investors hold more than $180,000 worth of SSBs.”

Why So Complicated Lah?

Okay, sounds good on paper, but many Singaporeans still find these options a bit confusing or worry about making the wrong choice. Let’s look at the common headaches and kancheong spots discussed online.

- Perceived Complexity, Especially T-Bills

SSBs were designed to be simple, but T-bills involve auctions and bidding (competitive vs non-competitive) which can seem intimidating for beginners. Some prefer the straightforward ‘apply and hold’ nature of SSBs.

“A lot of my friends and relatives find tbills complicated… They accept SSB better because can redeem anytime. And can just apply and don’t bother about it for 10 years…”

- Worry About Lock-in Periods

While SSBs offer amazing flexibility (redeem any month with no penalty, you just lose future interest), T-bills lock your money for 6 or 12 months. Even a 6-month wait makes some people nervous, especially if they might need the cash unexpectedly.

“Some worry the money is locked even if it is 6 mths. They accept SSB better because can redeem anytime.”

- Fear of Past Financial Mistakes

Some investors feel burnt by past decisions, like complex insurance plans that didn’t deliver. This makes them extra cautious and sometimes hesitant to try new things, even relatively safe options like SSBs or T-bills. Learning takes time and effort.

“Don’t laugh at me hor, I put in a dunno what insurance, after 20 years maturity, gave me back haize don’t say anymore liao. At least got back the capital, I no Money Mind, that is why come here to learn and repent my past mistakes.”

Steady Pom Pipi Moves

Don’t let the options paralyze you! With a bit of understanding, you can make smart choices for your savings. Here are some practical steps based on forum wisdom and official info.

- Know the Purpose: SSB vs T-Bill/SGS

Understand why each exists. SSBs are great for beginners or those prioritising flexibility – easy access, redeem anytime, good for long-term savings goals. If you’ve hit the $200k SSB limit or want different maturity options (like short-term T-bills), then explore T-bills or other Singapore Government Securities (SGS).

“The SSB programme was launched to promote greater participation… for individuals who lacked familiarity with SGS… SSBs allow bond holders to… get their money back in any given month with no penalty… Investors that have reached the $200,000 limit may wish to consider other products such as Treasury Bills or SGS bonds.”

- Use Official Resources (Like MAS)

Don’t rely purely on forum chatter or hearsay. Check the official MAS website for definitive info on SSB issuance, T-bill auction details, rules, and limits. Websites like ilovessb.com also provide helpful projections based on official data.

“Check MAS website: https://www.mas.gov.sg/bonds-and-bills/…” (Reference to official sources)

- Consider Your Life Stage & Needs

What works for a young professional saving for BTO might differ from a retiree managing their nest egg. If you value simplicity and quick access to funds, SSBs might be better. Especially for older folks, simpler options can reduce stress.

“post 65 better don’t go for SGS because harder to sell. Go for something simplier because when older the mind is less alert and maybe even get dementia.”

Choosing between SSBs and T-bills isn’t about finding one ‘best’ answer, but the best fit for *you*. Both are safe ways to make your savings work harder than just sitting in the bank. Assess your cash flow needs, how long you can park your money, and your comfort level with the application process. Check the latest rates and yields on the MAS website, maybe start small if you’re unsure, and build your confidence. Your future self will thank you for taking these steady steps today!

Read the original discussions on HardwareZone: