Eh, check your bank account interest lately? Feels like one moment shiok, next moment gone like that, right? Many popular savings accounts like UOB One and OCBC 360 are cutting their high interest rates from mid-2025. Suddenly, finding the best place to park our hard-earned cash feels like navigating the MRT during peak hour – crowded and confusing! Are you also wondering where to put your money now without jumping through too many hoops? Let’s break down what’s happening on the ground, based on what fellow Singaporeans are sharing online.

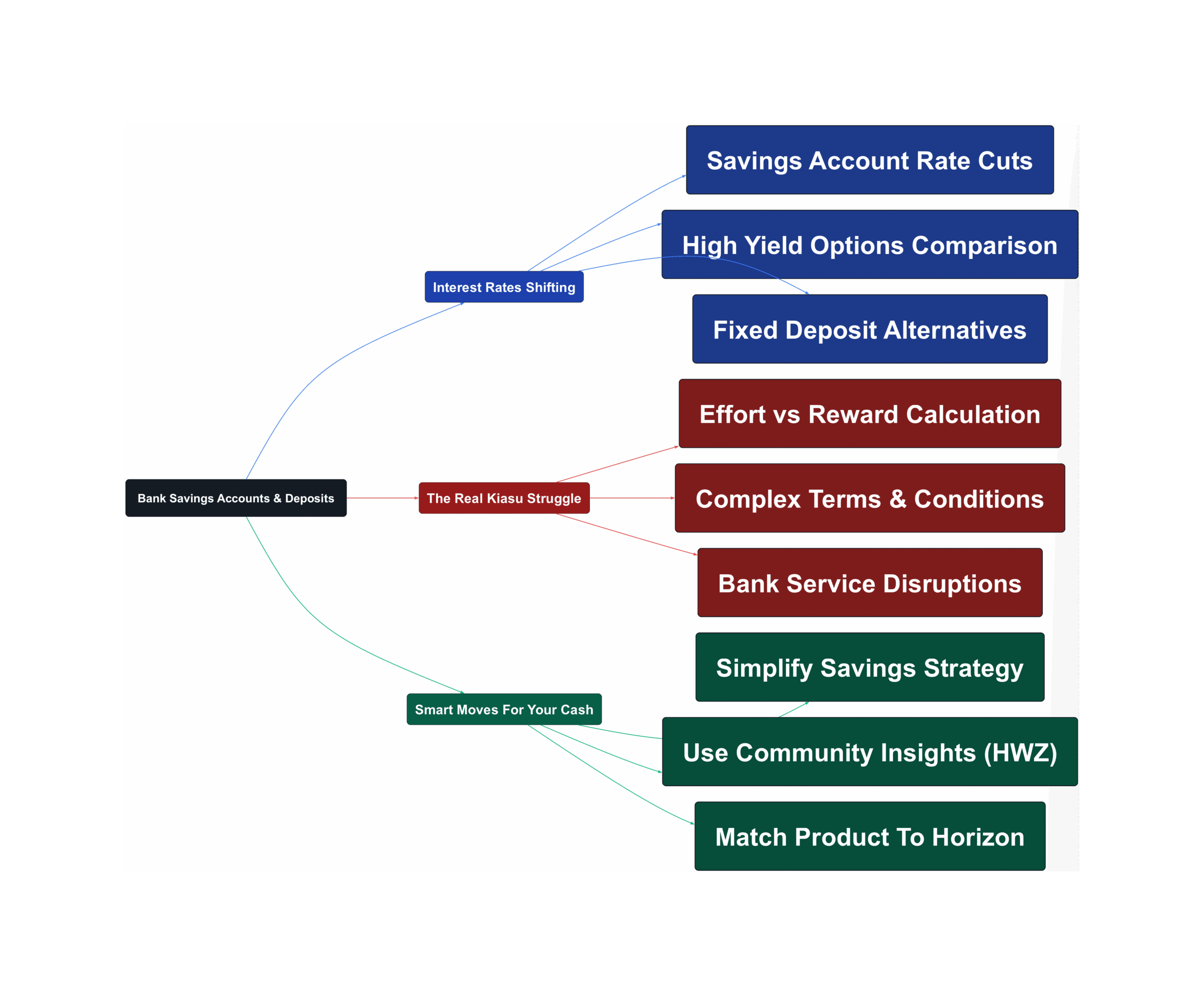

Interest Rates Shifting

The savings game in Singapore is changing fast, faster than the queue for famous hawker stalls! Banks that offered attractive high yields are now adjusting their rates downwards. It’s a trend many forum users are actively tracking and discussing.

- Major Banks Adjusting Rates

Big players like UOB and OCBC have announced reductions. For instance, UOB One’s bonus interest calculations changed from May 1st, 2025, leading to potentially lower payouts for the same balance. OCBC Premier Dividend+ is also set to reduce its rate significantly from June 2025.

“April 2025 was the final month before the new T&Cs kick in …. From 1st May 2025, [computed bonus interest is lower]”

- Promotions Becoming Less Generous

Even promotional offers are seeing cuts. HSBC’s EGA bonus interest promo for May 2025 dropped, especially for customers without wealth holdings. Standard Chartered’s eSaver invites also show varying bonus rates, indicating targeted, perhaps less widespread, offers.

“Latest May promo is out. Dropped to 2% for customers without wealth holdings, 2.7% for those with wealth holdings”

- Some Stable Options Remain (For Now)

Despite the cuts, some options like Singlife’s 3% p.a. on the first S$10,000 and UOB Stash offering 3% p.a. (on balances above S$10k up to S$100k, requiring monthly balance increase) are still holding steady, attracting those looking for relatively stable, albeit capped, returns. Fixed Deposits (FDs) from certain banks like Maybank (2.85% p.a. for 36 months via old app) or Singapura Finance (up to 2.875% p.a. for seniors) offer longer-term stability but require lock-ins.

The Real Kiasu Struggle

Trying to squeeze every last drop of interest can feel like a full-time job, lah. While we all want our money to work harder, the current environment throws up some real roadblocks and headaches that many Singaporeans can relate to.

- Chasing Rates = Mental Load

Is the extra effort worth the few dollars difference? Constantly monitoring rates, moving funds, tracking T&Cs, and meeting requirements (like minimum spends or salary credits) takes time and energy. Some find the mental load disproportionate to the gains, especially for smaller deposit amounts.

“The effort for just 10k. Look at the absolute numbers… For just $3.33 more per mth you need to manage another account.”

- Complex & Changing Terms

Banks can change terms and conditions (T&Cs) relatively quickly. What’s attractive today might change next month. Understanding tiered interest rates, qualifying periods for bonuses, and specific requirements needs careful reading of the fine print, which can be confusing.

“Fixed for as long as they say it is. can change anytime.”

- Unexpected Service Disruptions

Technical issues can add to the frustration. Recently, HSBC users experienced disruptions with FAST and PayNow services, causing delays in transfers and payments. While temporary, such incidents highlight potential vulnerabilities and inconvenience when managing multiple accounts actively.

“I made a FAST transfer from HSBC to DBS at 7AM today. Money gone from HSBC but haven’t reached DBS.”

Smart Moves For Your Cash

Okay, so things are changing, but don’t need to panic! There are still smart ways to manage your savings effectively in Singapore without losing sleep. Here are some practical steps discussed by the community:

- Simplify & Prioritize

Focus on accounts that offer decent returns for minimal fuss, especially for smaller amounts. Consider parking a base amount (e.g., S$10k) in a relatively stable high-yield account like Singlife (currently 3%) and treating it as ‘set and forget’. Evaluate if the extra effort for marginal gains on other accounts is truly worth your time.

“ok can treat this 10k @ 3% as like ur first 10k for any account and possibly not touching it”

- Stay Informed via Communities

Leverage online communities like HardwareZone forums. Fellow savers often share the latest updates, compare rates, dissect T&Cs, and flag issues faster than official channels. Reading threads dedicated to specific accounts (UOB One, Singlife, etc.) can provide timely insights and strategies.

“maybe y’all should open a proper UOB Stash thread to discuss this in depth… might be confusing to those who’re on UOB One accounts…”

- Consider Your Time Horizon & Risk

If you don’t need the cash immediately, Fixed Deposits (FDs) or products like Singapore Savings Bonds (SSBs) might offer better stability, though potentially lower returns than past high-yield savings accounts. For those comfortable with slightly more risk and effort, options like cash management accounts (e.g., Mari Invest) or even selling options (as mentioned by one user, requires knowledge!) could be explored, but understand the risks involved.

“Just sharing Singapura Finance got FD( Blue Sky FD Account ) 36mths for more than 50K interest 2.75%… One thing to note is if you breaks your FD no interest will be given.”

So, while the era of super high easy-access interest might be cooling off, staying informed and choosing strategies that match your effort level and financial goals is key. Don’t just leave your money idle; make conscious choices. Keep checking those rates, share tips with fellow Singaporeans, and find the balance that works best for you. Every dollar counts, right?

Read the original discussions on HardwareZone: