Eh, Singaporeans, let’s talk money. Ever wonder if you’re earning enough to keep up with the Joneses (or the Tan family next door)? We all do, right? Especially when you’re scrolling through your Instagram feed and seeing everyone’s ‘atas’ lifestyles. This week, we’re diving into the latest salary stats and what they mean for you, your CPF, and your future HDB or condo dreams.

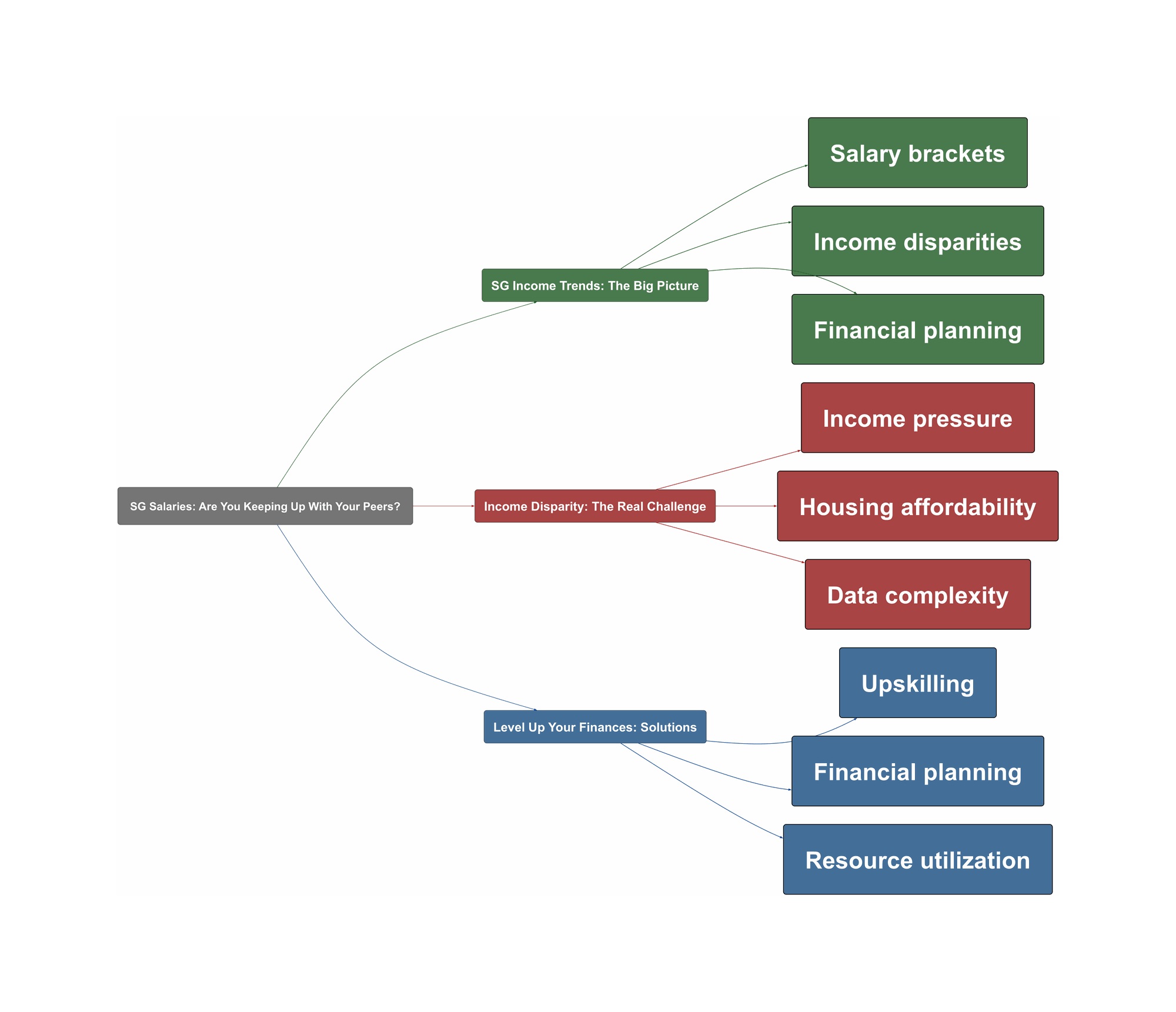

SG Income Trends: The Big Picture

The latest data from the Ministry of Manpower (MOM) shows the income landscape in Singapore. It paints a picture of how much your peers are earning. The numbers can be a bit confusing, but let’s break it down. A recent chart on Reddit sparked a lot of discussion about salary brackets. Some figures to note: Roughly 23.26% of residents earn less than $3,000 a month, while 11.89% make $12,000 or more. The median salary hovers around the $4,000-$5,000 mark.

“Does this track with what we see amongst our peers?”

These stats are a good starting point, but they don’t tell the whole story. Factors like age, education, and job experience play a huge role. As one Redditor pointed out, it’s not just about the numbers; it’s about who you’re comparing yourself to. Your career path also matters a lot. Some professions, like doctors or lawyers, often command higher salaries, and income level can be a good indicator of your social circle. The data refers to residents, not just citizens, so it includes PRs too.

Income Disparity: The Real Challenge

Okay, so the numbers are out there, but what’s the real issue? The biggest challenge is often the feeling of inadequacy or the pressure to keep up. Many Singaporeans feel stressed about not earning enough to afford the lifestyle they desire, especially when it comes to housing. The data doesn’t always reflect the lived experience. It’s easy to get lost in the numbers and feel like you’re falling behind, especially when the cost of living keeps rising.

“Feels like I would want to be at least in that 12k+ bracket to get into condos, especially if also thinking of getting a car.”

The data can also be confusing and inconsistent. Some Reddit users found the tables hard to understand, which adds to the frustration. Moreover, there’s a big divide between those with and without a university degree. The stats show a significant income gap, and it’s a real struggle for many to bridge that gap. It’s not just about the numbers; it’s about how these figures affect your everyday life, from your housing choices to your retirement plans.

Level Up Your Finances: Solutions

So, what can you do? First, understand that these stats are just a snapshot. Don’t let them define your self-worth. Instead, focus on what you can control: your skills, your career, and your financial planning. Consider upskilling or reskilling to boost your earning potential. Look into courses or certifications that can make you more competitive in the job market. Explore different career paths, and don’t be afraid to take calculated risks.

“The biggest dividing line is whether you are a uni grad and age.”

Next, create a solid financial plan. Start by budgeting and tracking your expenses. Look into CPF contributions and how they can benefit you long-term. Explore investment options, but do your homework first. There are plenty of resources available, from government websites to financial advisors, that can help you make informed decisions. Remember, it’s not always about earning more; it’s also about managing your money wisely. Finally, don’t compare yourself to others. Focus on your own journey and celebrate your progress.