Eh, Singaporeans! Thinking about where to stash your hard-earned money? You’re not alone. The HardwareZone forums are buzzing with discussions about the best savings accounts, latest promo updates, and the ever-present hunt for the highest interest rates. But sometimes, things get a little jialat, especially when dealing with bank promos. Let’s dive into what’s happening and how to make your money work harder in this current climate!

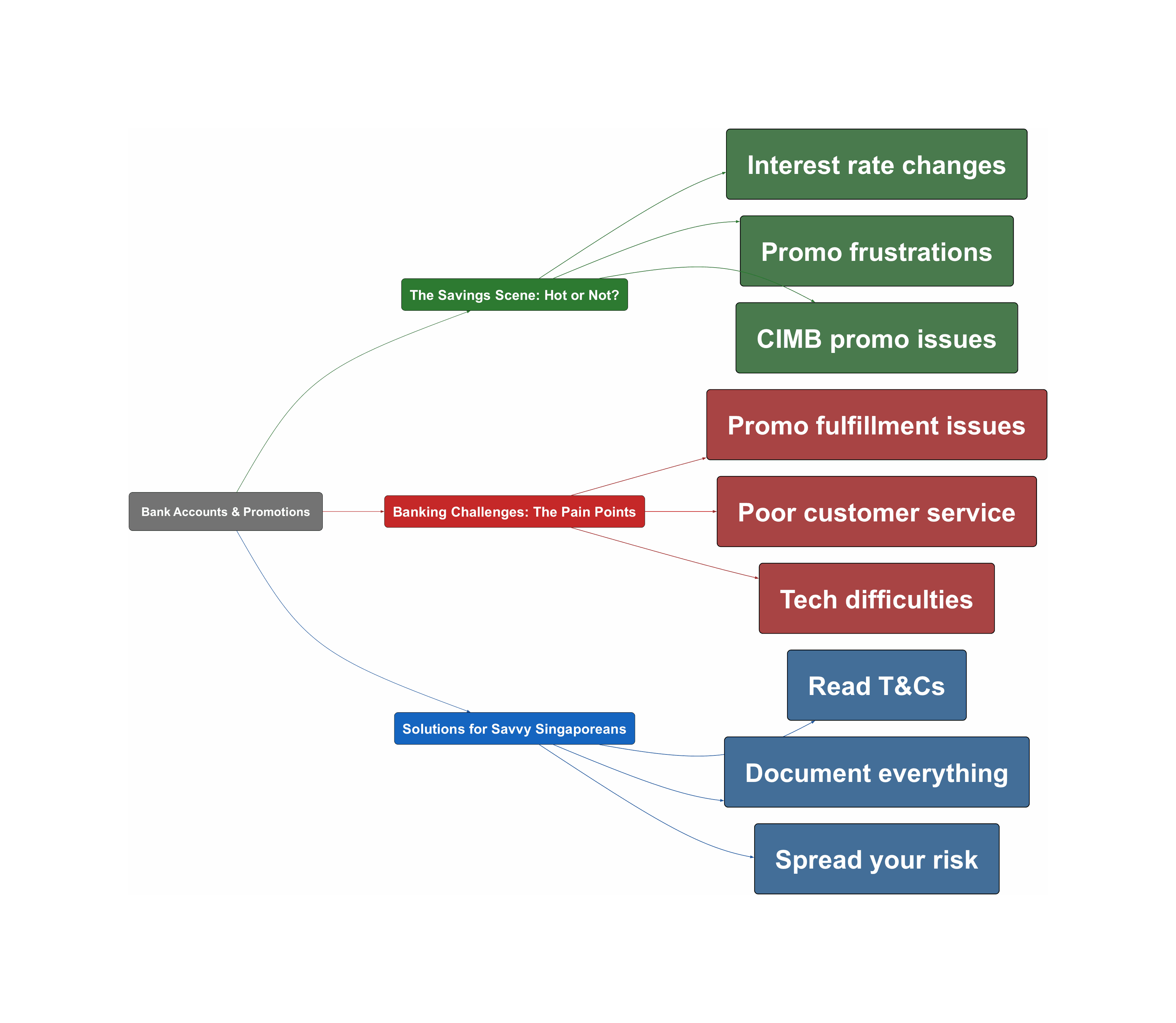

The Savings Scene: Hot or Not?

- Interest Rate Rollercoaster: Banks like Chocolate (formerly Singlife) and GXS are adjusting their interest rates.

“note upcoming changes to interest rate: Chocolate – 1 Feb – from 3.6% to 3.3% GXS – 11 Feb — from 2.68% to 2.38%”

- Promo Hopping is the Name of the Game: Singaporeans are actively spreading their funds across different banks to maximize returns and take advantage of promotions.

“Spread around choco, Singlife and Mari. I need flexibility for now.”

- CIMB’s Promo Saga: The CIMB FastSaver promo has caused quite a stir, with users facing delays in receiving promised bonuses and facing confusing T&Cs.

Banking Challenges: The Pain Points

- Promo Promises vs. Reality: Many HardwareZone users are frustrated with banks that don’t seem to honour their promotional terms, leading to disappointment and wasted effort.

“Still have not received the $150 from SI-cimb giro”

- Customer Service Struggles: Getting in touch with banks and getting straight answers is a challenge, with users reporting long wait times and inconsistent information.

“Their customer service, both on Message Centre and email are getting atrocious.”

- Tech Troubles: From app glitches to confusing registration processes, tech issues add another layer of frustration to the banking experience.

“HSBC really messy…I find it messy plus I thought maybe sit out of EGA in Feb and enrol my Joint account in Mar cycle since it has high bal in Jan.”

Solutions for Savvy Singaporeans

- Read the Fine Print: Always carefully review the terms and conditions of any promotion before signing up.

“Screenshot of the tnc”

- Document Everything: Keep records of all communications with the bank, including screenshots of promotions and chat logs.

“Correspondence with the bank should also be saved and archive.”

- Spread Your Risk: Diversify your savings across multiple accounts to mitigate the impact of rate changes or promo issues.

- Be Persistent: If you believe a bank hasn’t fulfilled its obligations, don’t hesitate to follow up and escalate the issue.

“Have to keep calling the CSO to pressure the bank. if they go against their own T&C, we have the right to bring this up to MAS correct?”

- Community Wisdom: Tap into the HardwareZone community for tips, advice, and shared experiences.

Read the original discussions on HardwareZone: