Your bank just slashed its interest rates. Again. That comfortable 4% you were enjoying is gone. Now you are left wondering where to park your hard-earned money. It feels like every good deal disappears too quickly. You are not alone in this struggle. Many Singaporeans are feeling the pinch as savings account rates fall across the island. The game has changed. But don’t worry, there are still smart ways to make your money work for you. Let’s explore what fellow Singaporeans on HardwareZone are doing about it.

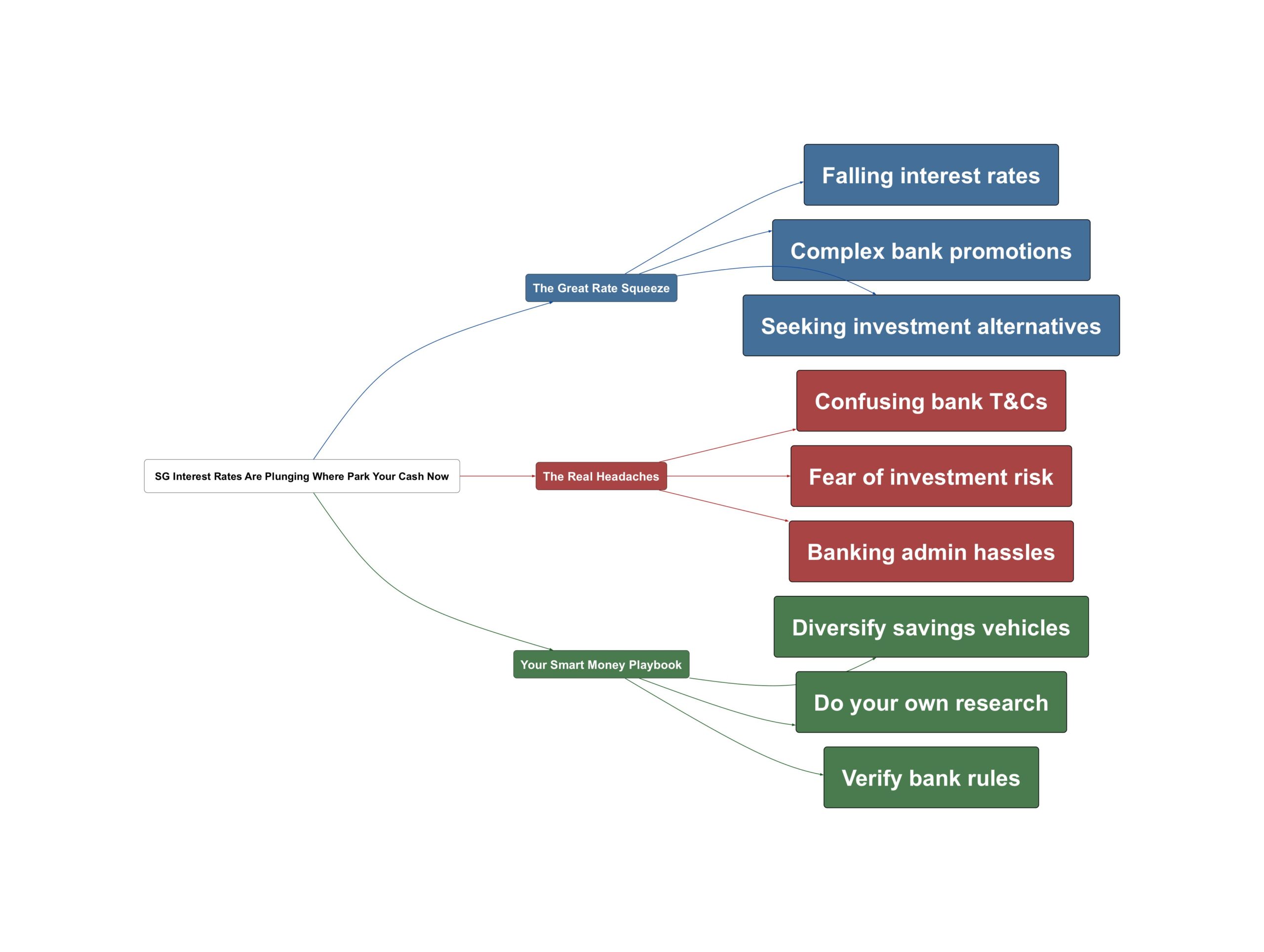

The Great Rate Squeeze

The landscape for savers in Singapore is shifting fast. High-yield accounts are becoming less common. Banks are now focusing on specific types of customers. This leaves many everyday savers feeling left out.

- High-yield savings accounts are losing their appeal

Banks are cutting interest rates on popular savings accounts. Fixed deposit rates are also dropping. This makes it harder to earn decent returns without taking on more risk. Savers now have to hunt for better options.

“The FDs rates now all lower than all the normal deposit promo, no point locking in anymore.”

- Banks are chasing affluent clients with targeted promos

You might have seen exclusive offers from banks like DBS Treasures. These promos offer higher interest caps, like $200,000 instead of the usual $100,000. However, they are often invite-only. This creates a gap between regular customers and priority clients.

“aiya actually all these i believe no point asking any cso/rm/csm cos i highly guessed its all automated ‘system targeted’ ones”

- Singaporeans are moving to cash management accounts

With traditional savings options becoming less attractive, people are exploring alternatives. Cash management accounts like Mari Invest are gaining popularity. They offer potentially higher returns. But they also come with the risk of capital loss as the NAV fluctuates.

“I guess this is a good place to hide some funds especially with interest rates going lower and lower.”

The Real Headaches

Navigating this new financial environment is not easy. Singaporeans face several challenges. From confusing rules to the fear of losing money, the path is full of obstacles. Here are the top concerns shared by the community.

- Understanding complex terms and conditions is a struggle

Bank promotions come with a lot of fine print. Terms like CASA, earmarked funds, and qualifying transactions can be confusing. It is hard to know if you are meeting all the criteria to earn bonus interest. This complexity makes financial planning difficult.

“Why some guy makes the simple tasks so complicated?”

- The fear of investment risk is very real

Many Singaporeans are risk-averse. They prefer the safety of savings accounts and fixed deposits. Moving money into investment products with fluctuating values is a big step. The thought of the NAV dropping and losing capital is a major deterrent for many.

“High risk high return, low risk low return, pretty simple, no rocket science on all these financial instruments.”

- Dealing with banking admin and security can be frustrating

Increased security measures can sometimes create hassles. Making multiple online payments might trigger fraud alerts and lock your account. Resolving these issues takes time and effort. Simple transactions can become complicated ordeals.

“I used my credit card do payment on AXS mobile app in blocks of $60, 10 consecutive times in less than 30min…. kena fraud detection system, kena locked out …”

Your Smart Money Playbook

Despite the challenges, there are clear strategies to stay ahead. The HardwareZone community offers practical advice. It is all about being proactive and informed. Here are some actionable steps you can take today.

- Diversify and ladder your funds strategically

Do not put all your eggs in one basket. Spread your money across different instruments. Consider staggering T-bill subscriptions so they mature at different times. This ensures you have a steady cash flow and can adapt to changing rates.

“I staggered T-bill subscriptions over the past few years so that they mature over several months rather than all at once.”

- Always do your own research before investing

Don’t follow trends blindly. What works for someone else may not suit your risk appetite. Take the time to understand any product before you put money into it. Read the terms, check historical performance, and make an informed decision.

“whatever kind of investment, always must research and dyodd before dive in, according to one’s risk appetite and time horizon”

- Verify information and document everything

If you are unsure about a promotion’s rules, ask the bank directly. Don’t rely on assumptions. If something goes wrong, having a record of your query can help. This gives you proof if you need to dispute an issue later on.

“contact them to lodge a case so at least you have something of substance to push a point if something breaks.”

The era of easy high interest might be over for now. But that doesn’t mean you have to settle for low returns. By staying informed, diversifying your savings, and being careful, you can navigate this tricky environment. Take control of your finances. Your future self will thank you for it.

Read the original discussions on HardwareZone: