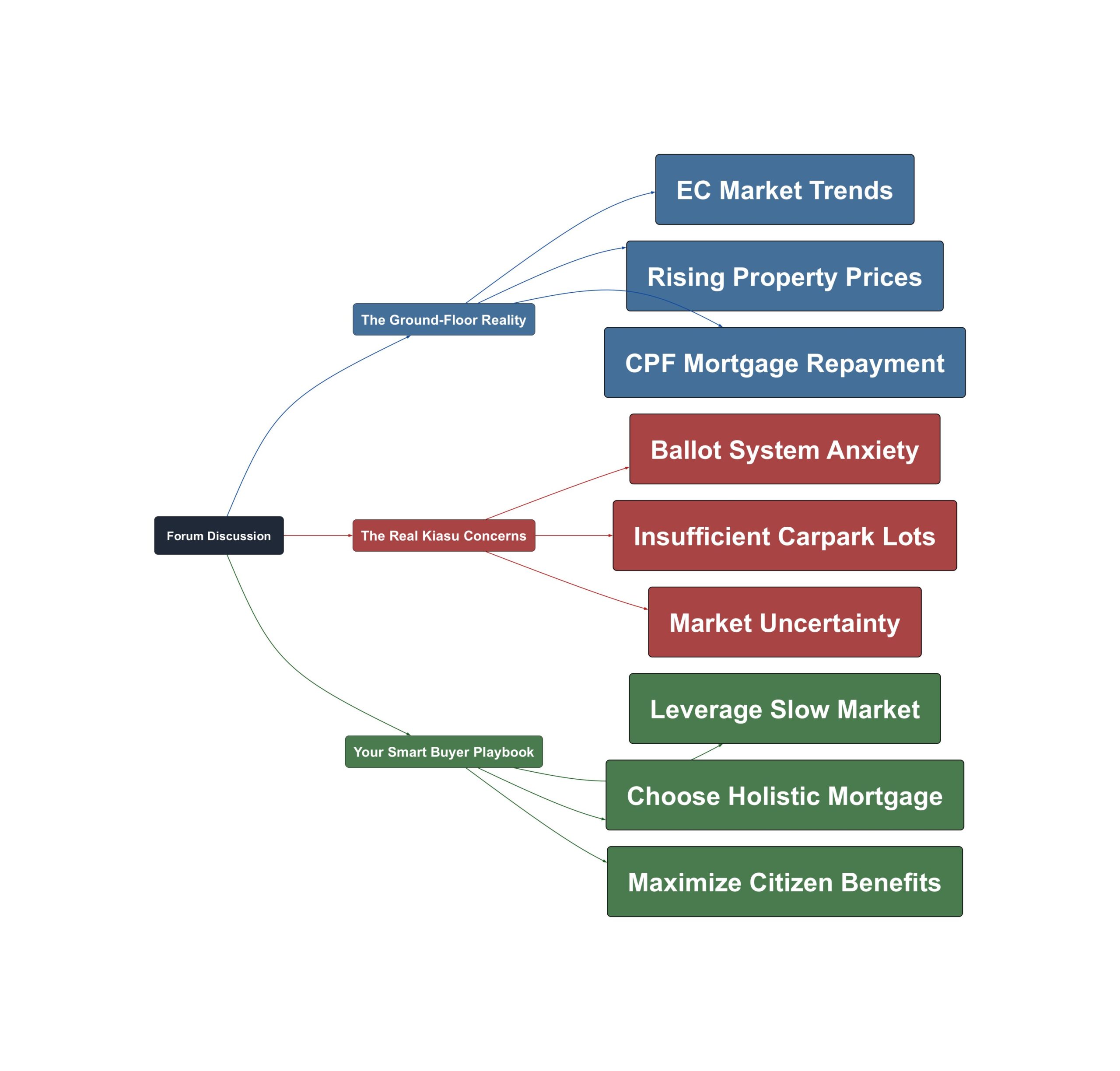

Thinking of buying a new home in Singapore? You see property prices climbing higher and higher. Yet, you hear some new launches have a poor response. It feels confusing and stressful. So what is really happening on the ground? Is the dream of owning a home slipping away? We dived into HardwareZone forums to find out what Singaporeans are actually experiencing. The answers might surprise you.

The Ground-Floor Reality

The market is sending mixed signals. Prices are up, but buyer turnout can be low. This creates a strange and complex environment for aspiring homeowners. Here is what is happening right now.

- EC prices are climbing fast

Data from recent launches shows a clear upward trend. Prices per square foot (psf) for Executive Condominiums have risen significantly over the past few years. This makes planning your finances even more critical.

“2022 oct copen grand 639 units average 1300psf 2023 aug Altura 360 units 1433psf 2024 jan lumina grand 512 units 1464psf 2024 nov novo place 504 units average 1654psf 2025 july otto place 600 units average 1700psf”

- Buyer response is surprisingly cool

Despite high prices, some new projects are not selling out. One forum member shared that a recent EC launch was only 54% sold. Many people with ballot numbers did not even show up to book a unit.

“Overall only 54% sold. Bad response. A lot of people never turn up for booking.”

- Second-timers are finding opportunities

The slow market can be a blessing for some. Second-time buyers, who often face tougher odds, are finding it easier to secure a home. It proves that opportunities exist if you are prepared.

“2nd timer can get already horseshiat luck liao. I got 31x in the queue. This bad market now negates all the effects of a lousy ballot queue now.”

The Real Kiasu Concerns

Buying a property in Singapore is more than just about money. It involves navigating a maze of rules, anxieties, and very practical problems. These are the main struggles buyers face.

- The stress of the ballot queue

The ballot system feels like a lottery. Getting a high queue number can feel like a disaster. This uncertainty adds a huge amount of stress to the home-buying journey.

“Couldn’t believe it when the last few are lead in. I got 31x and practically give up. I am also on the fence really. Miracles I guess!”

- Practical details cause major headaches

Sometimes, small details can become deal-breakers. For example, the number of carpark lots is a huge concern for families. A new launch with only 50% carpark availability is seen as a major flaw.

“Otto place is better coz u have 70% chance of getting a carpark. While novo place is 50% Coz ec doesn’t have one or two bedders, most families drive. So 50% carpark is really painful.”

- Understanding CPF and loan rules

Navigating mortgage repayments with CPF can be confusing. Many people overpay monthly on floating rate loans to cover potential hikes. This is a common practice, not a loophole.

“It is not what some says ‘is a cheat code’. For folks using CPF to repay a floating rate loan, they cannot adjust their CPF amount on a monthly basis. Naturally they have to put a ‘higher’ amount to cover possible upside.”

Your Smart Buyer Playbook

The market is tough, but not impossible. With the right strategy, you can still succeed. Here are actionable steps shared by fellow Singaporeans on how to navigate the current climate.

- Use a slow market to your advantage

A market with a ‘bad response’ is a buyer’s market. It reduces the competition from other buyers. This means your lousy ballot number might just be good enough to get you a unit.

“This bad market now negates all the effects of a lousy ballot queue now. A lot of people never turn up for booking.”

- Choose the right mortgage package

Do not just chase the lowest interest rate. The entire package matters, including features and bank service. Foreign banks may offer lower rates, but local banks might offer other advantages.

“the mortgage package is that more important thing. Rate/Feature must be good.”

- Leverage your Singaporean benefits

Remember to make full use of your advantages as a Singaporean. This includes grants and other benefits available for first or second-time buyers. It is a key part of securing your dream home.

“Actually, more of securing the dream home and taking full benefits and advantage of Singaporean for me.”

The Singapore property journey is challenging. It is filled with high prices and complex rules. However, insights from the community show a path forward. By staying informed and strategic, your dream home is still within reach. It is about playing your cards right in this unique market.

Read the original discussions on HardwareZone: