Remember when 4% interest was normal? Now, even getting 2% feels like a huge win. The latest T-bill rate just crashed to 1.68%. Many fixed deposits are offering even less. It feels like our savings are earning peanuts. Your hard-earned money is working less for you. So, where can you safely grow your cash in Singapore today? This is the big question on everyone’s mind.

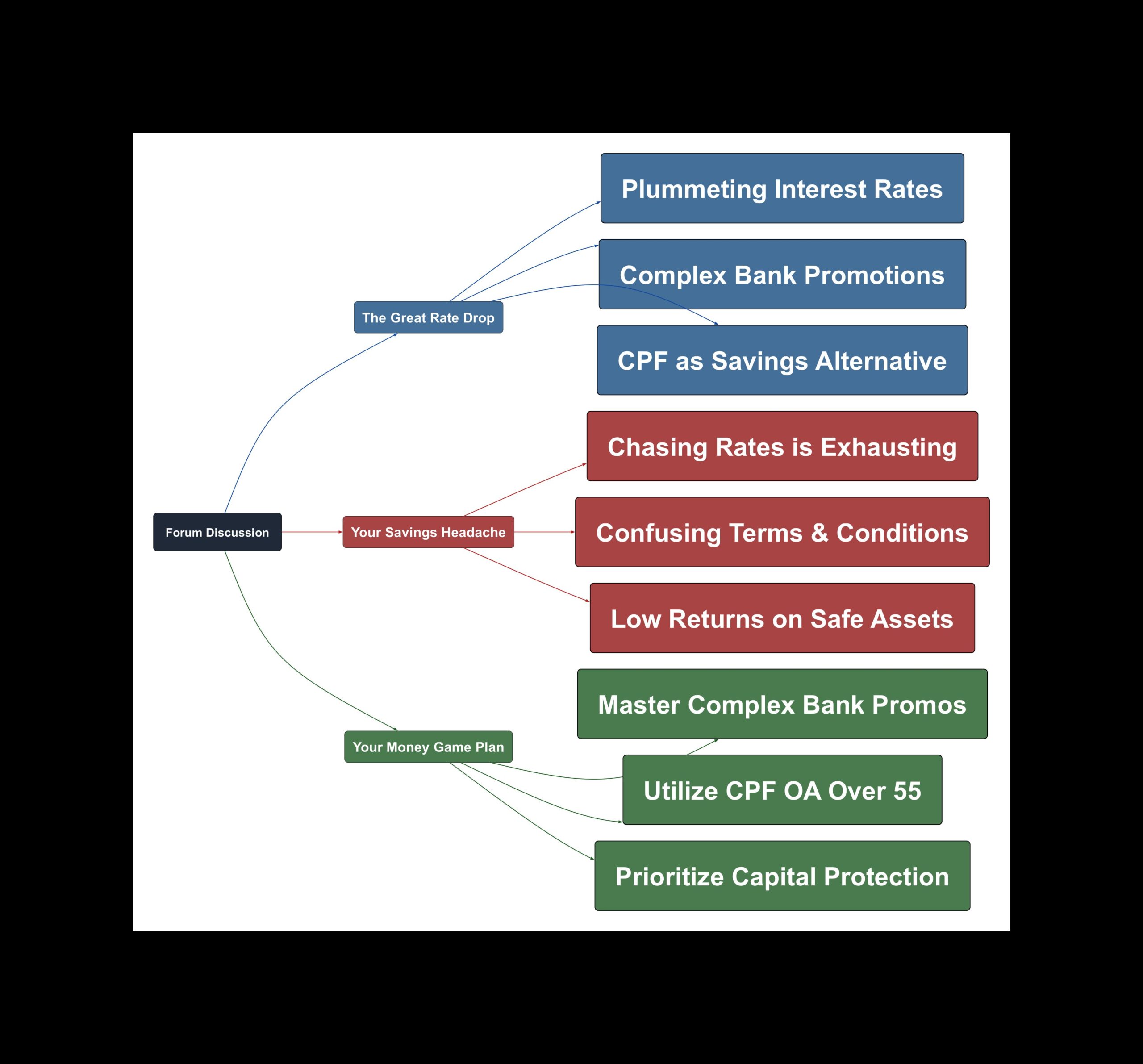

The Great Rate Drop

The golden era of high interest seems over. Singaporean savers are now facing a harsh reality. Rates are falling across all the usual safe havens. It is getting much harder to find a good place for your cash.

- T-Bills and FDs are now ‘peanuts’

The latest T-bill auction closed with a shockingly low yield of just 1.68%. At the same time, banks are slashing their fixed deposit rates. OCBC recently offered a ‘special’ rate of only 1.60%. This is a huge drop from the rates we saw just a year ago.

Sad. All TD become peanuts now…

I think it’ll take some time for us to get used to such ‘low’ rates hor? the last time we see 1.xx% is like 4, 5 years ago?

- High-yield accounts are now high-effort

To get higher returns, you must jump through many hoops. For example, some HSBC promotions offer a high effective rate. But they require huge deposits and multiple steps. You need to sign up for new accounts, use new cards, and track everything carefully.

Thanks. That’s a lot of hardwork.

- CPF is the new safe haven for seniors

For Singaporeans over 55, CPF is looking better than ever. Many are realizing their CPF Ordinary Account (OA) gives a stable 2.5% return. This is much higher than current T-bills or FDs. The money is also easily withdrawable for those who have met their retirement sums.

VHR is better than T-Bill now for uncles above 55 and FRS fulfilled. Super liquid.

Your Savings Headache

Trying to find the best savings rates is becoming a major headache. The rules are confusing. The effort is huge. And the fear of making a wrong move is real. This is causing a lot of stress for savers.

- Promo chasing is a full-time job

Banks offer complex promotions to attract funds. But keeping track of them is exhausting. You have to monitor bonus interest crediting dates. You need to check if your GIRO payments qualify. It requires constant attention to make sure you get the promised returns.

Moral of the story. Must put in effort to monitor.

- Confusing terms and poor service

Bank promotions come with complicated terms and conditions. Sometimes, even the customer service staff seem confused. Forum users report having to chase banks for missing bonus interest. This wastes a lot of time and energy.

One of the cs even get confuse about their own promo. Which i am not surprise as they are not as straightforward.

- Fear of locking in low rates

With rates falling, it is tempting to lock in a rate for a longer period. But many are hesitant. Some bank products, like the DBS Multiplier plan, may require you to lock in funds for years. This feels risky when you could get better returns elsewhere later.

the thought of 5k locked for 3 or 4 years don’t really appeal to me.. some more the insurance category unlock for 1 year only…

Your Money Game Plan

The environment has changed. But you can still make smart moves. Your strategy depends on your age, risk appetite, and how much effort you can spare. Here are three paths you can consider.

- Become a promo master (for the brave)

If you have significant cash and patience, you can play the banks’ game. One HardwareZone user detailed a plan to get an effective 3.77% yield from HSBC. It involves depositing $300,000 and completing many steps over six months. This path is not for everyone, but the rewards can be high.

Therefore prorated interest is = 4700/ 250000 *100 *365/182 = 3.77%

- Leverage your CPF (if you are over 55)

For those over 55 who have met their FRS and BHS, the CPF OA is a powerful tool. It offers a risk-free 2.5% interest rate. This beats almost any other safe option right now. You can also withdraw this money anytime you need it.

All above 55 with FRS and BHS, should consider pumping money into OA…instead of leaving money in banks, FDS or TBs or any instruments paying less than OA rate, which is withdrawable anytime…

- Prioritize simplicity and safety

If chasing promos sounds too tiring, focus on protecting your capital. T-bills and SSBs still have a role. Their yields are low, but your money is 100% safe. In uncertain times, peace of mind is also a valuable return.

I think it boils down to capital protection.

The high-rate party seems to be over for now. Growing your savings in Singapore requires more strategy than before. Whether you hunt for complex promos, use your CPF, or stick to simple products, the key is to have a plan. Know your options and choose the path that best fits your financial goals and lifestyle. Don’t let your hard-earned money sleep.

Read the original discussions on HardwareZone: